Freelance Visa (Type D) – Poland

A freelance visa allows qualified professionals to work as independent contractors in Poland. This visa is for freelancers, consultants, and self-employed individuals who want to provide services in Poland.

Table of Contents

What is a Freelance Visa for Poland?

A freelance visa allows qualified professionals to work as independent contractors and self-employed individuals in Poland. This visa is designed for freelancers, consultants, and entrepreneurs who want to provide professional services or run their own business in Poland.

The freelance visa is typically valid for up to one year and can be renewed. It allows you to register as a sole proprietor (działalność gospodarcza) in Poland and work independently with Polish and international clients while residing in the country.

This visa is ideal for digital nomads, consultants, creative professionals, and skilled workers who prefer the flexibility of self-employment over traditional employment arrangements.

Poland freelance visa application guide

Freelance Activities

Schengen Countries & Self-Employment

The Schengen area consists of 29 European countries. These include the EU member states except Ireland and Cyprus and the non-EU countries Switzerland, Liechtenstein, Norway, and Iceland. Citizens of these states and foreign nationals with a valid residence permit for one of these countries enjoy freedom of travel within the Schengen area — border controls only occur at external borders.

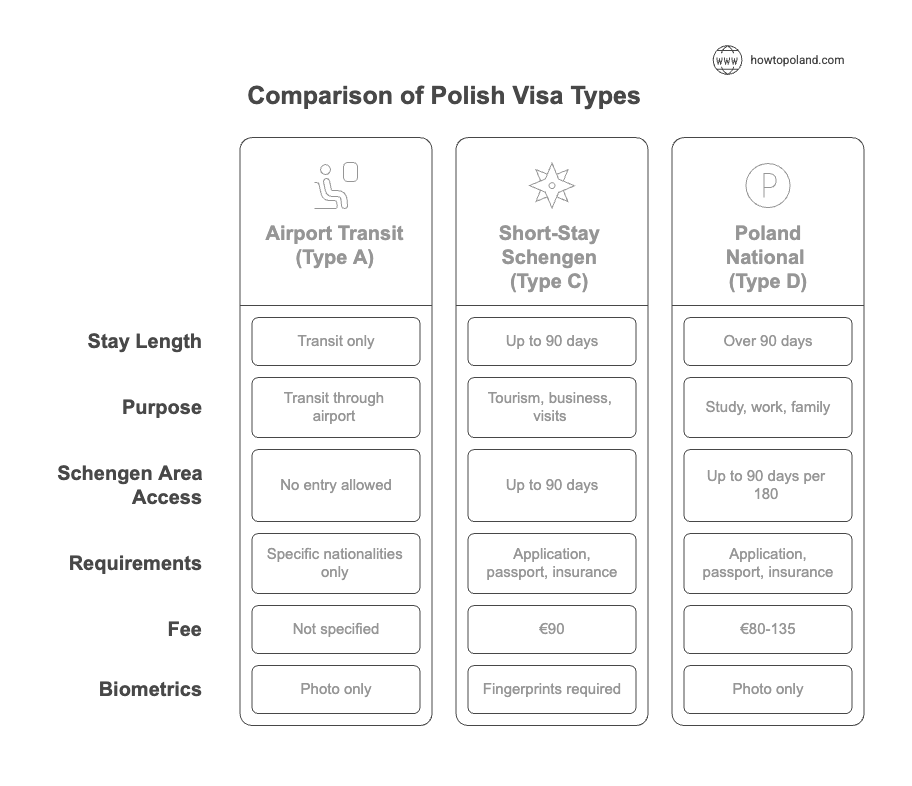

The issuance of visas for the Schengen countries is regulated uniformly – depending on the purpose of the trip and the length of the stay, the following visa categories may apply:

Popular Freelance Services

Poland freelance visa holders commonly work in these fields:

Important Note

Freelance visa holders must register their business activity in Poland and comply with all tax and social insurance obligations. For official information, visit the Polish Ministry of Foreign Affairs website.

Freelance Visa Types

Freelance/Self-Employment Visa

For independent contractors and freelancers

Business Activity Visa

For establishing business or professional services

Requirements and Documents

Required Documents

Important Requirements

Business Plan

Detailed plan outlining your freelance services, target market, and financial projections.

Financial Means

Minimum €3,000 in bank account to demonstrate ability to support yourself initially.

Professional Portfolio

Evidence of your skills and previous work experience in your freelance field.

Eligibility Criteria

To qualify for a freelance visa, you must meet specific eligibility criteria that demonstrate your ability to work independently and contribute to the Polish economy:

You Must Meet

- Relevant education or professional experience in your field

- Sufficient financial resources to support yourself

- Clear business plan for freelance activities

- Skills in demand in the Polish market

- Clean criminal record from home country

- Health insurance covering stay in Poland

- Intention to work as independent contractor

Business Registration Process

After receiving your freelance visa, you must complete several registration steps to legally operate as a freelancer in Poland:

Business Registration

Register as sole proprietor (działalność gospodarcza) in Poland

Must be completed within 30 days of arrival

Tax Registration

Register with Polish tax authorities (Urząd Skarbowy)

Required for all business activities and tax obligations

Social Insurance

Register with ZUS (Social Insurance Institution)

Mandatory social security and health insurance contributions

Tax Obligations

As a freelancer in Poland, you'll be subject to income tax (PIT) and may qualify for preferential tax rates for new businesses. You'll also need to make monthly ZUS contributions for social insurance and healthcare.

Frequently Asked Questions

Can I work for clients outside Poland with a freelance visa?▼

Yes, you can work for both Polish and international clients. However, you must be registered as a business in Poland and pay taxes on all income earned while residing in Poland.

How much money do I need to show for a freelance visa?▼

You typically need to demonstrate at least €3,000 in your bank account, though requirements may vary. This shows you can support yourself initially while establishing your freelance business.

Do I need to register a business immediately after arrival?▼

Yes, you must register your business activity (działalność gospodarcza) within 30 days of arrival in Poland. This includes registration with tax authorities and ZUS.

Can I hire employees as a freelancer?▼

As a sole proprietor, you can hire employees, but this involves additional tax and social insurance obligations. Consider consulting with a Polish accountant for proper setup.

Is the freelance visa renewable?▼

Yes, freelance visas can typically be renewed if you continue to meet the requirements and demonstrate successful business activity. You may also be eligible for permanent residence after 5 years.

Ready to Start Your Freelance Career in Poland?

Prepare your business plan and portfolio early. Contact the Polish consulate in your country for specific requirements and start your application process.