How to Open a Bank Account in Poland

Opening a bank account in Poland as a foreigner might seem complicated, but it's actually quite straightforward when you know the process. Whether you're moving to Poland for work, study, or personal reasons, having a local bank account is essential for managing your finances, receiving salary payments, and handling daily transactions. This comprehensive guide will walk you through every step of the process, from choosing the right bank to receiving your first Polish bank card.

Table of Contents

Banking in Poland for Foreigners

Why should I open a bank account in Poland?

You require a bank account for almost all everyday financial transactions in Poland. You can also receive and send payments via an international account – thanks to online banking and a globally accepted debit or credit card, you can remain financially flexible. However, with a bank outside the SEPA area, you must expect high costs and longer transfer times.

What is SEPA?

SEPA — Single Euro Payments Area — is a common European payment area that includes all European Union countries and some other states. The SEPA area has standardized payment terms. Non-cash transfers from a Polish bank account are often completely free for private customers within the SEPA zone.

International banks typically also operate branches in Poland. You can transfer your international bank account to Poland with such a provider. You then have a domestic Polish account and can also use the services of your home bank. However, such an account transfer is not always possible. Even international banks with Polish operations typically require the new opening of a Polish bank account.

Polish bank account — 3 different account types

A Polish bank account for expats can be one of three different account types:

Current account (Konto Osobiste)

This type is intended for everyday expenses. You can use it to pay your bills and receive payments. Current accounts are the most common type of bank account in Poland. They are indispensable in everyday life and are offered by almost all banks. You can typically choose between several account models with different services and conditions. Current accounts are partly free of charge, with other providers and account models incurring monthly fees.

With your current account, you will receive a debit card and usually access to online banking. Polish debit cards (VISA or Mastercard) are accepted worldwide and work seamlessly with contactless payments and BLIK mobile payments. To help you choose the right bank, compare the best current accounts in Poland.

Savings account (Konto Oszczędnościowe)

You invest unneeded funds in a savings account and earn interest. Term deposits and high-yield savings accounts are particularly popular in Poland because they offer better interest rates than regular accounts.

You need a checking account as a reference account because you cannot use a savings account for your daily expenses and income. Many banks also offer their customers this account in addition to checking accounts. There are typically no fees for managing basic savings accounts. For detailed information about interest rates and terms, explore high-yield savings accounts in Poland.

Student account (Konto Studenckie)

International students can benefit from special student accounts that offer reduced fees and additional benefits. These accounts are designed specifically for students and often include free transfers, no monthly fees, and special offers for young people.

Student accounts typically require proof of enrollment at a Polish university or college. Many banks also offer student credit cards and overdraft facilities with favorable terms for students. To discover which banks offer the best student benefits, find student-friendly banks in Poland.

Which Poland banks are recommendable?

Poland has a very diverse banking landscape. You can choose between numerous banks with different services and profiles as an expat. Some basic information will help to find a bank that best meets your requirements and wishes.

Traditional Polish Banks

Traditional banks like PKO Bank Polski, Bank Pekao, and Santander offer extensive branch networks and comprehensive services. These banks are ideal if you prefer in-person banking and need access to physical locations across Poland.

- Extensive ATM and branch networks

- Full range of banking services

- Established reputation and stability

Digital-First Banks

Modern digital banks like mBank and international options like Revolut focus on mobile-first banking with innovative features. These are perfect for tech-savvy expats who prefer managing their finances online.

- Award-winning mobile applications

- Lower fees and competitive rates

- Complete English language support

Our Top Recommendations for Expats

There are over 50 commercial banks operating in Poland. These include major providers such as PKO Bank Polski and Bank Pekao, which offer services to a broad range of customers. Other, mostly digital-focused banks like mBank and international providers like Revolut offer their services primarily to tech-savvy customers and international professionals.

The major Polish banks operate extensive nationwide networks of branches and ATMs. You can take advantage of online banking, mobile apps, and personalized advisory services at the branches. In addition to current accounts, they offer their customers numerous other banking services including savings accounts, loans, and investment products.

The advantages of Polish current accounts include free cash withdrawals at extensive ATM networks nationwide. PKO Bank Polski operates the largest ATM network with over 20,000 machines, while mBank and other digital banks focus on fee-free international transactions and superior mobile banking experiences. By comparison, using foreign bank cards in Poland can result in significant foreign exchange fees and withdrawal charges.

Under certain conditions, expats can also open current accounts at these banks before entering Poland or without a Polish residence permit. Many banks now offer online account opening processes specifically designed for international customers.

Based on our extensive research and user feedback, we recommend three banks that consistently deliver excellent service for foreigners living in Poland. mBank stands out as our top choice for most expats due to its superior digital banking experience and complete English support:

mBank - Best Digital Banking

Digital-first users and tech professionals

Key Features

Account Details

Summary

PKO Bank Polski - Most Popular

First-time expats and students

Key Features

Account Details

Summary

Alior Bank - Modern Banking

Tech-savvy users and young professionals

Key Features

Account Details

Summary

Why these recommendations? All three banks offer complete English support and zero monthly fees for basic accounts. mBank leads with digital innovation, Revolut excels in international flexibility, and Alior Bank provides modern banking solutions with innovative features.

Digital Neo-Banks

Digital startups and neo-banks have changed banking in Poland. While there are many options available, we recommend Revolut because of its reliability, simplicity, and the fact that we use it ourselves.

Revolut offers excellent customer support, even provides eSIM cards, and you can open an account much faster than with traditional banks. No residence permit required, no branch visits needed.

Revolut - Best International Banking

International professionals and digital nomads

Revolut

Best International Banking

Key Features

Account Details

Summary

Banking Fees in Poland

Before deciding on a particular bank and account model, you should compare not only the profiles of the providers but also the fees for the account and other banking services. You can find information on this in the banks' lists of prices and services, or their general terms and conditions. However, for many established banks, this information is only available in Polish. Bilingual (Polish, English) or multilingual services play a much more important role for neo-banks.

Understanding Polish banking costs

The following aspects are particularly important when comparing prices

Account maintenance fees

Many banks charge a monthly fee for their current accounts, which ranges between 5-15 PLN ($1.20-$3.60 / €1.10-€3.30) on average. Premium accounts can be significantly pricier, reaching up to 50 PLN ($12 / €11) monthly. However, this price is often offset by extensive additional services such as free international transfers, premium customer support, and comprehensive insurance packages. For expats who travel internationally frequently, investing in premium accounts can be highly worthwhile.

However, you can also find current accounts without monthly fees. mBank and Revolut offer completely free accounts without conditions. Many traditional banks require a minimum monthly deposit (typically 2,000-3,000 PLN / $480-$720 / €440-€660) for free account management.

Transfers

SEPA transfers from private customers are free of charge at most banks within Poland and the EU. However, high fees may be charged for outgoing and incoming international transfers outside the SEPA zone. Suppose you often make or receive international transfers. In that case, you need a current account – for example, from mBank, Revolut, or Wise – that supports these services under favorable conditions.

Traditional banks may charge 20-50 PLN ($4.80-$12 / €4.40-€11) for international transfers, while digital banks like Revolut offer real exchange rates with minimal fees.

Cash withdrawals

There can also be huge differences in the costs for cash withdrawals. Free ATM withdrawals are mainly offered by banks that have a nationwide network of branches or belong to an ATM network. PKO Bank Polski operates the largest ATM network with over 20,000 machines, while other banks typically charge 3-5 PLN ($0.70-$1.20 / €0.65-€1.10) for foreign ATM usage.

Digital banks typically offer free monthly allowances for cash withdrawals. mBank provides 5 free withdrawals monthly, while Revolut offers different limits based on your account tier. For all further withdrawals, rather moderate fees apply.

In addition to the conditions for cash withdrawals in Poland, you should also check the costs for foreign withdrawals. Neo-banks often offer particularly attractive conditions for international ATM usage.

Debit and Credit Cards

Cards can also be a relevant cost factor for a current account. Debit cards are typically available free of charge or for a small monthly fee (5-10 PLN / $1.20-$2.40 / €1.10-€2.20). On the other hand, credit cards sometimes incur annual fees ranging from 50-200 PLN ($12-$48 / €11-€44) that do not always reflect the services provided by the cards.

mBank and Revolut offer free debit cards with excellent international acceptance, while traditional banks may charge for premium card features.

Credit cards – also available without an account

Suppose you are interested in a credit card with an overdraft facility. In that case, the offers from the bank where you hold your current account are not always the first choice. In Poland, you can apply for a credit card without being tied to a specific current account. Besides fee-based offers, free credit cards are available on the market with no annual fee, particularly from international providers like Revolut.

Student accounts

Suppose you are studying in Poland or are under 26 years of age. In that case, you can open a particularly low-priced current account at most Polish banks. Popular options include PKO Student, mBank Student, and Millennium Student accounts. Some providers require proof of your age, while others require a student certificate from your university.

Student accounts typically offer enhanced benefits such as free international transfers, higher ATM withdrawal limits, and reduced fees for premium services.

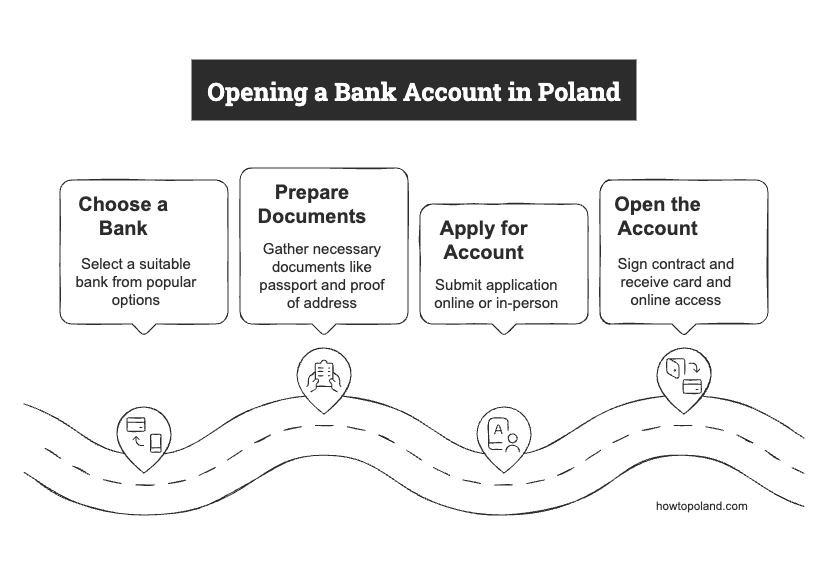

Opening a Polish Bank Account

Traditional banks let you open accounts either at branches or online. Digital banks like mBank and Revolut handle everything through their apps.

Required documents

- Valid passport or EU ID card

- Proof of address (rental contract, utility bill, hotel booking)

- Employment proof or student enrollment

Most banks need a PESEL number, but you can get one during the account opening process. International banks like Revolut skip this requirement entirely.

No PESEL yet?

Without Polish credit history, traditional banks might hesitate. Neo-banks don't care about your PESEL history and offer accounts immediately.

Identity verification

Branch visits require showing your passport in person. Online applications use video calls for verification - takes about 5 minutes and you're done.

Frequently Asked Questions

Can I open an account without a Polish residence permit?▼

Yes, some neo-banks like Revolut and Wise allow you to open an account without a Polish residence permit or proof of residence.

What documents do I need?▼

You typically require a valid passport, residence permit or visa, proof of address, and employment or student status.

What is PESEL and do I need it?▼

PESEL is Poland's personal identification number system. Lack of PESEL history may limit options for accounts with credit facilities, but neo-banks often offer PESEL-free accounts.

Are there free bank accounts available?▼

Can freelancers and self-employed open business accounts?▼

Yes. Banks offer freelancers and self-employed business accounts tailored to their needs. We particularly recommend the business accounts of fintechs and neo-banks to freelancers and the self-employed, as they often come with excellent digital features for accounting and tax.

How long does account opening take?▼

Online accounts can be opened in 15-20 minutes. Branch visits take 30-60 minutes. Your debit card arrives within 5-7 business days.

Ready to Open Your Polish Bank Account?

Start with our top recommended banks for foreigners. Both offer excellent English support and easy account opening processes.