Loans in Poland for Foreigners

Are you a foreigner living in Poland and need a loan? With various options available, choosing the right loan provider can be challenging. This guide will help you navigate Polish lending, comparing online lenders, traditional banks, and specialized services for expats, while providing essential information on requirements, interest rates, and application processes. Let's find the best loan solution for you!

Table of Contents

Wandoo

Foreigners seeking quick 1-month cash with easy approval

Wandoo

Foreigners seeking quick 1-month cash with easy approval

Key Features

Loan Details

Summary

Vivigo

Foreigners needing instant cash with 0% interest

Vivigo

Foreigners needing instant cash with 0% interest

Key Features

Loan Details

Summary

Net Gotówka

All foreigners with stable income

Net Gotówka

All foreigners with stable income

Key Features

Loan Details

Summary

Alior Bank

All foreigners with stable income and good credit

Alior Bank

All foreigners with stable income and good credit

Key Features

Loan Details

Summary

Revolut

Foreigners with Revolut account seeking quick loans

Revolut

Foreigners with Revolut account seeking quick loans

Key Features

Loan Details

Summary

Important Information

Most Polish loan providers offer their services primarily in Polish. Use your browser's translation feature to navigate in English. If certain functions don't work in the translated version, switch back to Polish. Many providers offer English-speaking customer service through dedicated phone lines or online chat support.

Why You Can Trust Us

We are independent from the providers of the financial products that we test and evaluate.

We are transparent regarding our research processes and evaluation methods.

Our content undergoes careful quality check to ensure that it is well-researched, factually correct, and understandable.

We have extensive experience with financial products and understand what expats in Poland want and need.

Choosing the Right Loan Provider in Poland

When selecting a loan provider in Poland, it's crucial to consider factors such as eligibility requirements, interest rates, processing time, and language support. Recently, the Polish lending market has witnessed significant digital transformation, with many providers offering innovative features like instant approval, competitive rates, and English-language support. However, traditional banks remain popular among locals and expats alike due to their established reputation and comprehensive services.

Having access to credit in Poland is essential for various purposes, including emergency expenses, major purchases, and financial flexibility. A personal loan can help you cover unexpected costs, consolidate debt, or make important investments. In the following sections, we'll delve deeper into the factors you should consider when choosing a loan provider in Poland.

How to Get a Loan as a Foreigner in Poland

Eligibility Requirements and Nationality Restrictions

Eligibility requirements and nationality restrictions are crucial aspects to consider when selecting a loan provider in Poland, especially for expats and non-Polish citizens. While some providers like Wandoo and Vivigo are restricted to Ukrainian citizens only, others like Net Gotówka welcome all foreign nationals with proper documentation.

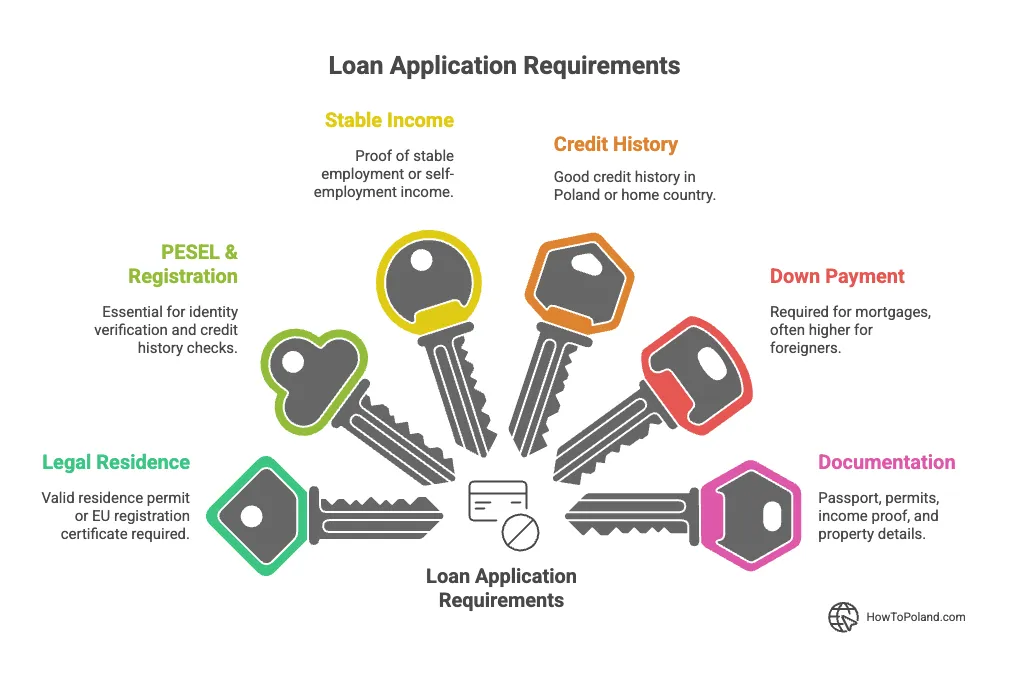

Most loan providers require a valid residence permit, proof of income, and a Polish bank account. Some may also require a PESEL number and proof of stable employment. It's essential to check eligibility requirements before applying to avoid rejection and potential negative impact on your credit score.

Interest Rates and Fees

Understanding the interest rate structure is vital when choosing a loan provider in Poland. Interest rates can vary significantly between providers, from 0% promotional rates to 30% or higher for high-risk borrowers. Many providers offer promotional rates for first-time borrowers or specific nationalities.

It's essential to compare not just the interest rate but also any additional fees, such as processing fees, early repayment penalties, and late payment charges. Some providers may offer lower interest rates but charge higher fees, making the overall cost higher.

Processing Time and Convenience

Poland has embraced digital lending significantly, with many providers offering instant or same-day approval. While traditional banks may take several days to process applications, online lenders can often provide decisions within minutes and transfer funds the same day.

Consider the application process when choosing your provider. Some offer completely online applications with digital document verification, while others may require in-person visits or document submission. Mobile apps and English-language support can make the process much more convenient for foreign borrowers.

If you need funds quickly, online lenders like Wandoo and Vivigo offer the fastest approval times. However, if you prefer more traditional banking relationships and don't mind waiting longer, traditional banks may offer better rates and more comprehensive services.

Best Online Lenders for Expats and Foreigners

Digital lending in Poland has advanced significantly, with several providers offering instant approval and streamlined online applications. Here are the top three lenders that consistently receive positive feedback from the expat community.

Wandoo

Wandoo is the go-to option for foreigners who need cash fast with almost instant approvals. The process is completely online, requires minimal documentation, and decisions are usually delivered in 15 minutes, making it ideal for emergency situations.

Vivigo

Vivigo offers the fastest approval process with 0% interest rates. Their mobile app provides instant access to emergency cash with no paperwork required.

Net Gotówka

Net Gotówka welcomes all foreign nationals and offers higher loan amounts up to 15,000 PLN. Their flexible terms and English support make them ideal for expats with stable income.

Revolut

Revolut still works well for app-based borrowers who already keep their salary or savings inside Revolut. Expect lower loan amounts but extremely fast processing with account analysis instead of traditional paperwork.

Quick tip: Start with Wandoo for the fastest approval and the simplest process. If you're Ukrainian, also consider Vivigo for instant approval. For higher amounts, Net Gotówka offers accessible loans with reasonable terms. Revolut users can still get quick loans through account analysis, but it's best if the other lenders don't fit your situation.

How to Get a Loan as a Foreigner in Poland

The reality is that getting a loan in Poland as a foreigner has become much more accessible than most expats realize. What's changed isn't just the number of lenders willing to work with foreigners, but their understanding of expat situations - irregular income patterns, lack of Polish credit history, and different employment arrangements that were once automatic rejections.

The Polish lending market now includes specialized online platforms that evaluate applications differently than traditional banks. Instead of focusing solely on employment contracts, many lenders look at actual money flow in your account, making the process more realistic for freelancers, remote workers, and people with non-traditional income sources.

What separates successful applications from rejections usually comes down to preparation and choosing the right type of lender for your specific situation rather than applying everywhere and hoping something sticks. Before you start applying for loans, make sure you have a solid banking foundation - check our bank accounts guide to find the best options for foreigners.

The Application Process That Actually Works

| Step | What You're Actually Doing | Time Needed | Documents Required | Reality Check |

|---|---|---|---|---|

| Research | Compare 3-4 lenders based on your profile | 15-30 minutes | None | Don't waste time on lenders that don't accept your employment type |

| Application | Complete online form in one session | 10-20 minutes | ID, PESEL, bank details | Incomplete applications often expire - finish in one go |

| Verification | Bank account and identity checks | 5 minutes - 2 hours | Bank login or statements | Most rejections happen here if your account looks messy |

| Assessment | Automated credit scoring + manual review | 30 minutes - 3 days | Income proof (sometimes) | Online lenders are faster but traditional banks offer better rates |

| Funding | Money transferred to your account | Instant - 24 hours | None | Weekends and holidays delay transfers |

What You Actually Need (Not the Wishlist)

Must-haves:

- ✓Valid passport or EU ID card

- ✓PESEL number that's been active for at least 2 weeks

- ✓Polish bank account with 2-3 months of transaction history

- ✓Proof you live in Poland (residence card, rental agreement, or utility bill)

Despite what many sites claim, "stable income" doesn't necessarily mean a traditional employment contract. Many lenders now accept freelance payments, foreign transfers, or mixed income sources - as long as money regularly appears in your Polish account.

Practical Tips That Make a Difference

Before applying:

- •Clean up your bank account history - cover any overdrafts

- •Apply between Tuesday-Thursday, 10 AM-3 PM

- •Have digital copies of all documents ready

During the process:

- •Answer phone calls from unknown Polish numbers

- •Respond to verification requests immediately

- •Don't apply to multiple lenders simultaneously

Common Roadblocks and Workarounds

"We need Polish credit history"

Try online lenders first - they're more flexible about credit history requirements. Some even view lack of Polish debt positively.

"Your income documentation isn't sufficient"

If you're freelancing or working remotely, bank statements showing consistent incoming transfers often work better than trying to explain complex employment arrangements.

Language barriers

Several major lenders now offer English customer service. If the website is only in Polish, their customer support usually isn't - call and ask.

PESEL complications

Your PESEL needs to be active in the government system before lenders can verify it. If you just received it, wait 2-3 weeks before applying.

The key insight most guides miss is that loan approval in Poland isn't just about meeting requirements - it's about matching your profile to the right type of lender and presenting your financial situation in the clearest possible way.

Frequently Asked Questions About Loans for Foreigners in Poland

Can foreigners get loans in Poland?▼

What documents do I need to apply for a loan?▼

You'll typically need a valid passport or EU ID card, PESEL number (active for at least 2 weeks), Polish bank account with 2-3 months of transaction history, and proof of residence in Poland (residence card, rental agreement, or utility bill). Some lenders may also require income documentation.

How long does it take to get approved?▼

Approval times vary by lender. Online fintech companies like Revolut can approve loans in 5-15 minutes, while platforms like Wandoo typically take 15 minutes. Traditional banks may take 1-3 days. The fastest approvals usually come from online lenders that use account analysis rather than traditional credit checks.

Do I need Polish credit history to get a loan?▼

Not necessarily. Many online lenders, especially fintech companies, evaluate applications based on your actual money flow in your Polish bank account rather than traditional credit history. Some lenders even view the lack of Polish debt positively. However, traditional banks may still require Polish credit history.

What's the difference between online lenders and traditional banks?▼

Online lenders (like Revolut, Wandoo) typically offer faster approval, more flexible requirements for foreigners, and simpler application processes. Traditional banks (like Alior Bank) usually offer better interest rates and higher loan amounts but require more documentation and have stricter requirements.

Can I get a loan if I'm self-employed or work remotely?▼

Yes, many lenders now accept non-traditional income sources. Online lenders often look at your bank account activity rather than employment contracts. If you have consistent money flow in your Polish account from freelance work or remote employment, you have good chances of approval with the right lender.

What should I do if my loan application is rejected?▼

Don't apply to multiple lenders simultaneously as it can hurt your credit score. Instead, wait 2-3 weeks, clean up your bank account history (cover overdrafts, avoid unusual transactions), and try a different type of lender. Online lenders are often more flexible than traditional banks for foreign applicants.

Are there any hidden fees I should know about?▼

Most reputable lenders are transparent about fees. Look for lenders that advertise "no hidden fees" like Wandoo. Always read the terms and conditions carefully. Some lenders may have processing fees, early repayment penalties, or other charges that aren't immediately obvious.

Ready to Apply for a Loan in Poland?

Choose from our top-ranked loan providers and get the funds you need. Compare rates, read requirements, and find the perfect loan for your situation.