How to Get a Loan in Poland for Foreigners

The reality is that getting a loan in Poland as a foreigner has become much more accessible than most expats realize. This comprehensive guide will walk you through the entire process, from choosing the right lender to receiving your funds, with practical tips and real-world advice.

Table of Contents

Overview: Getting a Loan as a Foreigner in Poland

The reality is that getting a loan in Poland as a foreigner has become much more accessible than most expats realize. What's changed isn't just the number of lenders willing to work with foreigners, but their understanding of expat situations - irregular income patterns, lack of Polish credit history, and different employment arrangements that were once automatic rejections.

The Polish lending market now includes specialized online platforms that evaluate applications differently than traditional banks. Instead of focusing solely on employment contracts, many lenders look at actual money flow in your account, making the process more realistic for freelancers, remote workers, and people with non-traditional income sources.

What separates successful applications from rejections usually comes down to preparation and choosing the right type of lender for your specific situation rather than applying everywhere and hoping something sticks. Before you start applying for loans, make sure you have a solid banking foundation - check our bank accounts guide to find the best options for foreigners.

Getting a loan in Poland is easier than you think

Recommended Lenders for Foreigners

These lenders have proven track records with foreign applicants and offer the best combination of approval rates, speed, and terms.

Revolut

Foreigners with Revolut account seeking quick loans

Key Benefits:

- Most popular choice among foreigners

- Account analysis-based approval

- Quick and straightforward application process

Wandoo

Foreigners seeking quick 1-month cash with easy approval

Key Benefits:

- Quick approval in 15 minutes

- Completely online process

- No hidden fees

Net Gotówka

All foreigners with stable income

Key Benefits:

- Available to all foreign nationals

- Higher loan amounts up to 15,000 PLN

- English customer support

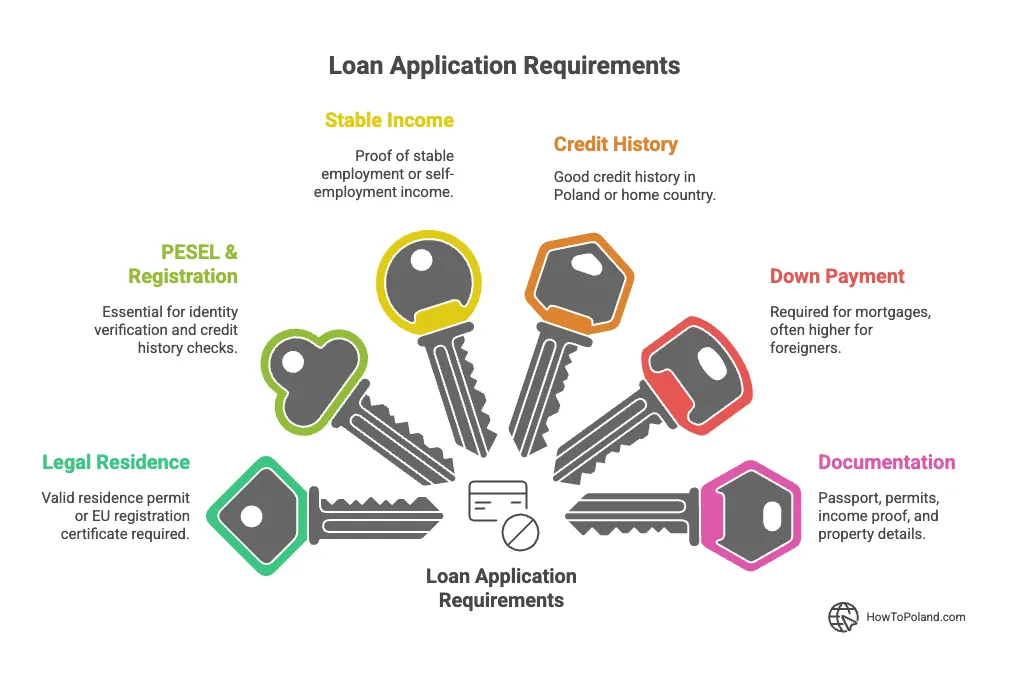

Requirements and Documents Needed

Despite what many sites claim, "stable income" doesn't necessarily mean a traditional employment contract. Many lenders now accept freelance payments, foreign transfers, or mixed income sources - as long as money regularly appears in your Polish account.

- Valid passport (original and copy)

- European ID card (for EU citizens)

- Residence permit or temporary residence card

- PESEL number (active for at least 2 weeks)

- Polish bank account with 2-3 months of transaction history

- Proof of income (salary certificate, employment contract)

- Bank statements showing regular income

- Tax returns (if self-employed)

- Rental agreement (umowa najmu)

- Utility bill (not older than 3 months)

- Residence card or temporary residence permit

- Address registration confirmation

What You Actually Need (Not the Wishlist)

Must-haves:

- ✓Valid passport or EU ID card

- ✓PESEL number that's been active for at least 2 weeks

- ✓Polish bank account with 2-3 months of transaction history

- ✓Proof you live in Poland (residence card, rental agreement, or utility bill)

Step-by-Step Application Process

The application process that actually works. Follow these steps to maximize your chances of approval.

| Step | What You're Actually Doing | Time Needed | Documents Required | Reality Check |

|---|---|---|---|---|

| Research | Compare 3-4 lenders based on your profile | 15-30 minutes | None | Don't waste time on lenders that don't accept your employment type |

| Application | Complete online form in one session | 10-20 minutes | ID, PESEL, bank details | Incomplete applications often expire - finish in one go |

| Verification | Bank account and identity checks | 5 minutes - 2 hours | Bank login or statements | Most rejections happen here if your account looks messy |

| Assessment | Automated credit scoring + manual review | 30 minutes - 3 days | Income proof (sometimes) | Online lenders are faster but traditional banks offer better rates |

| Funding | Money transferred to your account | Instant - 24 hours | None | Weekends and holidays delay transfers |

Compare 3-4 lenders based on your profile. Don't waste time on lenders that don't accept your employment type.

Tips:

- •Online lenders (Revolut, Wandoo) are more flexible for foreigners

- •Traditional banks (Alior Bank) offer better rates but stricter requirements

- •Check eligibility requirements before applying

- •Compare interest rates, fees, and processing times

Gather all required documents before starting the application. Having everything ready speeds up the process significantly.

Tips:

- •Ensure your PESEL has been active for at least 2 weeks

- •Clean up your bank account history - cover any overdrafts

- •Have digital copies of all documents ready

- •Make sure bank statements show consistent income

Fill out the online application form in one session. Incomplete applications often expire - finish in one go.

Tips:

- •Apply between Tuesday-Thursday, 10 AM-3 PM for faster processing

- •Provide accurate information matching your documents

- •Don't apply to multiple lenders simultaneously

- •Answer all questions truthfully

The lender will verify your bank account and identity. Most rejections happen here if your account looks messy.

Tips:

- •Answer phone calls from unknown Polish numbers

- •Respond to verification requests immediately

- •Be available during business hours

- •Ensure your bank account is accessible for verification

The lender will assess your application using automated credit scoring and manual review.

Tips:

- •Online lenders are faster (30 minutes - 24 hours)

- •Traditional banks may take 1-3 days

- •Don't apply elsewhere while waiting

- •Check your email and phone regularly

Once approved, funds will be transferred to your account. Weekends and holidays may delay transfers.

Tips:

- •Funds typically arrive within 24 hours

- •Some lenders offer instant transfers

- •Check your account balance after transfer

- •Read the loan agreement carefully before accepting

Practical Tips That Make a Difference

- •Clean up your bank account history - cover any overdrafts

- •Apply between Tuesday-Thursday, 10 AM-3 PM

- •Have digital copies of all documents ready

- •Ensure your PESEL has been active for at least 2 weeks

- •Answer phone calls from unknown Polish numbers

- •Respond to verification requests immediately

- •Don't apply to multiple lenders simultaneously

- •Be available during business hours

Common Roadblocks and Workarounds

"We need Polish credit history"

Try online lenders first - they're more flexible about credit history requirements. Some even view lack of Polish debt positively.

"Your income documentation isn't sufficient"

If you're freelancing or working remotely, bank statements showing consistent incoming transfers often work better than trying to explain complex employment arrangements.

Language barriers

Several major lenders now offer English customer service. If the website is only in Polish, their customer support usually isn't - call and ask.

PESEL complications

Your PESEL needs to be active in the government system before lenders can verify it. If you just received it, wait 2-3 weeks before applying.

The key insight most guides miss is that loan approval in Poland isn't just about meeting requirements - it's about matching your profile to the right type of lender and presenting your financial situation in the clearest possible way.

Important Information

Most Polish loan providers offer their services primarily in Polish. Use your browser's translation feature to navigate in English. If certain functions don't work in the translated version, switch back to Polish. Many providers offer English-speaking customer service through dedicated phone lines or online chat support.

Frequently Asked Questions

Can foreigners get loans in Poland?▼

Yes, many Polish lenders now offer loans to foreigners. The key is choosing the right type of lender for your situation. Online fintech companies like Revolut and specialized platforms like Wandoo are often more flexible with foreign applicants than traditional banks.

What documents do I need to apply for a loan?▼

You'll typically need a valid passport or EU ID card, PESEL number (active for at least 2 weeks), Polish bank account with 2-3 months of transaction history, and proof of residence in Poland (residence card, rental agreement, or utility bill). Some lenders may also require income documentation.

How long does it take to get approved?▼

Approval times vary by lender. Online fintech companies like Revolut can approve loans in 5-15 minutes, while platforms like Wandoo typically take 15 minutes. Traditional banks may take 1-3 days. The fastest approvals usually come from online lenders that use account analysis rather than traditional credit checks.

Do I need Polish credit history to get a loan?▼

Not necessarily. Many online lenders, especially fintech companies, evaluate applications based on your actual money flow in your Polish bank account rather than traditional credit history. Some lenders even view the lack of Polish debt positively. However, traditional banks may still require Polish credit history.

Can I get a loan if I'm self-employed or work remotely?▼

Yes, many lenders now accept non-traditional income sources. Online lenders often look at your bank account activity rather than employment contracts. If you have consistent money flow in your Polish account from freelance work or remote employment, you have good chances of approval with the right lender.

What should I do if my loan application is rejected?▼

Don't apply to multiple lenders simultaneously as it can hurt your credit score. Instead, wait 2-3 weeks, clean up your bank account history (cover overdrafts, avoid unusual transactions), and try a different type of lender. Online lenders are often more flexible than traditional banks for foreign applicants.

Ready to Apply for a Loan in Poland?

Choose from our top-ranked loan providers and get the funds you need. Compare rates, read requirements, and find the perfect loan for your situation.