Tax Return in Poland

Filing a Polish tax return can lead to tax refunds when you declare various expenses and deductions. In this guide, you'll learn when it's necessary to file a tax return, the potential savings, and important considerations during the process.

Table of Contents

Tax Return Basics in Poland

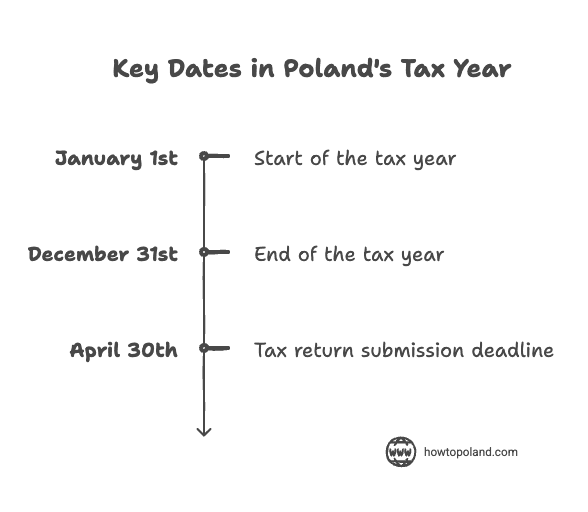

Filing an annual tax return in Poland is mandatory for most residents and certain categories of income earners. The Polish tax year runs from January 1st to December 31st, and tax returns must be submitted by April 30th of the following year. Understanding your obligations and the filing process is crucial for maintaining compliance with Polish tax law.

Poland uses a progressive tax system with rates ranging from 12% to 32% for most income types. The tax return process allows you to declare all income sources, claim eligible deductions, and calculate your final tax liability. Many taxpayers are entitled to refunds, especially those who had excess tax withheld from their salaries throughout the year.

Important Tax Return Deadlines

The standard deadline for filing your annual tax return in Poland is April 30th of the year following the tax year. For example, your 2025 tax return must be filed by April 30, 2025. However, if you file electronically through the official government portal, you automatically receive an extension until May 31st.

Missing the filing deadline can result in penalties, even if you don't owe any additional tax. Late filing penalties start at 1/30th of the minimum wage for each day of delay. If you're expecting a refund, filing early ensures faster processing and earlier receipt of your money.

Online Filing vs Paper Submission

The Polish tax authorities strongly encourage electronic filing through their official e-Deklaracje system. Online filing offers several advantages including automatic calculations, instant submission confirmation, faster refund processing, and the extended May 31st deadline. The system is available in Polish, but many tax preparation software options offer English interfaces.

Paper returns can still be submitted to local tax offices or sent by registered mail, but they must be postmarked by April 30th. Paper filing typically results in longer processing times and requires manual verification of all calculations. Most expats find online filing more convenient and efficient.

Common Tax Deductions and Credits

Polish tax law allows various deductions that can significantly reduce your tax liability. The most common include the personal allowance (3,600 PLN annually), work-related expenses, health insurance premiums, and charitable donations. Parents can claim child allowances, and there are special deductions for young taxpayers under 26.

Professional expenses can be deducted if you're employed, including work-related travel, training courses, professional literature, and home office costs. Self-employed individuals and business owners have additional deduction opportunities for business expenses, equipment purchases, and operational costs.

Keep detailed records and receipts for all claimed deductions. The tax authorities may request documentation during audits, and improper claims can result in penalties and additional tax assessments. When in doubt, consult a qualified tax advisor familiar with Polish tax law.

Filing Requirements and Tax Forms

Who Must File a Tax Return

Most individuals earning income in Poland must file an annual tax return, regardless of nationality. This includes Polish residents, EU citizens working in Poland, and non-EU expats with Polish tax residency. The filing requirement applies even if you had taxes withheld from your salary throughout the year, as the return serves as a final reconciliation.

Mandatory filing applies to: Employees with annual income above 8,000 PLN, self-employed individuals, business owners, property rental income earners, and anyone with multiple income sources. Even if your employer handled tax withholding, you may still need to file if you had additional income, changed jobs during the year, or want to claim deductions.

Optional but beneficial filing: Some taxpayers can choose whether to file, particularly those with simple employment situations. However, filing is often worthwhile as many people receive refunds due to overpaid taxes, especially if they worked part of the year or had varying income levels.

Understanding who must file tax returns in Poland

Polish Tax Forms (PIT)

Poland uses several different PIT (Personal Income Tax) forms depending on your income sources and tax situation. Choosing the correct form is essential for proper filing and avoiding processing delays.

PIT-37 - Standard Form

Most Common Form

Used by employees, pensioners, and those with standard income sources.

PIT-37 is the standard form for most taxpayers in Poland. It covers employment income, pensions, rental income, and most other common income types. This form allows you to claim standard deductions and credits.

- • Employment income (salary, wages)

- • Pension and retirement benefits

- • Rental income from property

- • Interest and dividend income

- • Capital gains from investments

PIT-36 - Business Income

For Business Owners

Used by self-employed individuals and those with business income.

PIT-36 is designed for taxpayers with business income, including sole proprietors, freelancers, and contractors. This form allows for more detailed business expense deductions and different calculation methods.

- • Self-employment income

- • Freelance and contract work

- • Business partnership income

- • Professional services income

- • Detailed business expense deductions

Other PIT Forms

Several specialized forms exist for specific situations. PIT-38 is used for capital gains from property sales,PIT-39 for certain types of investment income, and PIT-36L for simplified business taxation under the lump-sum method.

PIT-38

- • Property sale capital gains

- • Real estate transactions

- • Investment property income

PIT-39

- • Investment fund income

- • Securities transactions

- • Financial instrument gains

PIT-36L

- • Lump-sum taxation

- • Simplified business filing

- • Fixed-rate tax calculation

Frequently Asked Questions About Tax Returns in Poland

When is the deadline for filing my Polish tax return?▼

The standard deadline is April 30th of the year following the tax year. However, if you file electronically through the official government portal, you automatically get an extension until May 31st. For example, your 2025 tax return is due by April 30, 2025 (or May 31st if filed online).

Do I need to file a tax return if my employer already withheld taxes?▼

In most cases, yes. Even if your employer withheld taxes, you're still required to file an annual return if your income exceeded 8,000 PLN. Filing is often beneficial as many people receive refunds due to overpaid taxes, especially if they changed jobs during the year or are eligible for deductions.

Which PIT form should I use for my tax return?▼

Most employees use PIT-37 for standard employment income, pensions, and rental income. Self-employed individuals and business owners typically use PIT-36. If you have capital gains from property sales, use PIT-38. When in doubt, consult the tax office or use online tax software that can recommend the correct form.

Can I file my Polish tax return online in English?▼

The official government portal (e-Deklaracje) is in Polish, but many commercial tax preparation software options offer English interfaces. Online filing provides benefits like automatic calculations, extended deadlines, and faster refund processing. You can also use browser translation tools for the official portal.

What deductions can I claim on my Polish tax return?▼

Common deductions include the personal allowance (3,600 PLN), work-related expenses, health insurance premiums, charitable donations, and child allowances. Professional expenses like training, work travel, and home office costs may also be deductible. Keep all receipts and documentation for claimed deductions.

How long does it take to receive a tax refund in Poland?▼

Tax refunds typically take 45-90 days to process after filing. Electronic filing generally results in faster processing than paper returns. The refund is usually deposited directly into your bank account if you provided account details on your return. You can check the status online through the tax office portal.

What happens if I miss the tax return deadline?▼

Late filing penalties start at 1/30th of the minimum wage for each day of delay, even if you don't owe additional tax. If you owe money, interest charges also apply. File as soon as possible to minimize penalties. In exceptional circumstances, you may be able to appeal penalties or request a payment plan.

Do I need to file a Polish tax return if I'm leaving the country?▼

Yes, if you earned income in Poland during the tax year, you must file a return regardless of when you leave. You may be entitled to a refund if you worked only part of the year. Consider filing early to receive any refund before leaving. Notify the tax office of your address change for correspondence.