VAT in Poland

Value-added tax (VAT) in Poland is a consumption tax that businesses charge on goods and services. The standard VAT rate in Poland is 23%, with reduced rates of 8% and 5% for certain items. VAT represents a significant portion of Poland's revenue, accounting for about 40% of its total tax earnings.

Table of Contents

What is VAT?

Value-added tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution. Unlike a simple sales tax, VAT is collected incrementally, based on the surplus value added to a product by a business at each stage of production. This system ensures that tax is paid at every step of the supply chain, making it one of the most efficient forms of indirect taxation.

In Poland, VAT is a crucial component of the tax system, contributing significantly to government revenue. Understanding VAT is essential for businesses operating in Poland, as it affects pricing, cash flow, and compliance obligations. Whether you're a small entrepreneur or running a large corporation, proper VAT management is vital for legal compliance and financial planning.

Understanding VAT obligations and compliance in Poland.

Photo: Tax documentation and calculation

How VAT Works in Practice

When you purchase goods or services in Poland, you pay VAT in addition to the net price. For businesses, VAT operates on a system of input and output tax, creating a chain of tax collection throughout the supply process. This mechanism ensures that the final consumer bears the full VAT burden while businesses act as intermediaries in the collection process.

The VAT system includes Output VAT (charged on your sales to customers), Input VAT (paid on your business purchases), and your VAT liability (Output VAT minus Input VAT). If positive, you pay the difference to tax authorities; if negative, you receive a refund. This system prevents double taxation and ensures businesses only pay VAT on the value they add to products or services.

VAT Registration and Small Business Exemptions

In Poland, businesses with annual turnover exceeding 200,000 PLN must register for VAT and charge it on all sales. However, smaller businesses can opt to be exempt from VAT obligations under certain conditions, similar to small business regulations in other EU countries. This exemption can provide administrative relief and potentially competitive pricing advantages for qualifying businesses.

Important to note: VAT-exempt businesses cannot reclaim input VAT they've paid on their purchases. This trade-off between administrative simplicity and VAT recovery should be carefully considered when deciding whether to register voluntarily for VAT or remain exempt under the small business threshold.

VAT for International Business and EU Transactions

Poland's EU membership means special VAT rules apply for cross-border transactions. Intra-EU B2B sales typically qualify for 0% VAT, provided proper documentation and valid EU VAT numbers are obtained. This facilitates trade within the European Union while maintaining tax compliance across different member states.

For businesses selling to consumers in other EU countries, distance selling thresholds apply. Once you exceed €10,000 in sales to consumers in another EU country, you must register for VAT in that country or use the One Stop Shop (OSS) scheme for simplified reporting.

Digital services have special rules where the customer's location determines the applicable VAT rate, regardless of where your business is established. Understanding these international VAT obligations is crucial for businesses operating across EU borders or serving international customers from Poland.

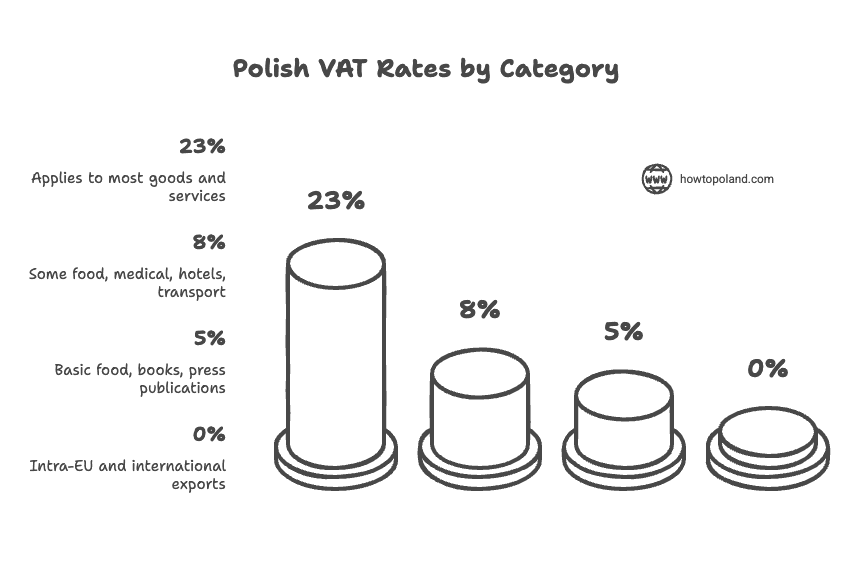

Polish VAT Rates

Poland applies four different VAT rates depending on the type of goods or services provided. The standard rate is 23% for most goods and services, including electronics, clothing, professional services, and hospitality. This is one of the higher VAT rates in the European Union, reflecting Poland's fiscal policy approach.

Reduced rates of 8% and 5% apply to essential goods and services. The 8% rate covers selected foods, pharmaceuticals, medical devices, books, newspapers, takeaway food, hotel accommodation, and public transport. The super-reduced 5% rate applies to basic foods like bread, milk, meat, fruits, and vegetables.

A 0% rate applies to exports outside the EU, international transport, and certain medical services. Understanding which rate applies to your business is crucial for proper pricing and VAT compliance. When in doubt, consult the Polish tax authorities (KAS) or a qualified tax advisor, as VAT rates can change based on government policy.

Infographic: Polish VAT Rate Structure

VAT Registration in Poland

VAT registration in Poland depends on your business turnover and strategic choices. Understanding when registration is mandatory versus voluntary, and the implications of each option, is crucial for proper business planning and tax compliance.

Mandatory Registration

Annual turnover exceeds 200,000 PLN

Must register before starting business activity or within 14 days of exceeding the threshold.

Once your business crosses the 200,000 PLN annual threshold, VAT registration becomes mandatory. This applies whether you're a sole trader, partnership, or corporation. The registration process is straightforward but must be completed promptly to avoid penalties.

- • Register using VAT-R form

- • Submit to local tax office

- • Receive EU VAT ID number (PL format)

- • Begin charging VAT immediately

- • File monthly or quarterly VAT returns

Voluntary Registration

Annual turnover below 200,000 PLN

Can choose to register voluntarily to reclaim input VAT on business expenses.

Voluntary registration can be beneficial if you have significant business expenses with VAT. However, once registered, you're committed to charging VAT on all sales and filing regular returns, even if your turnover remains below the threshold.

- • Can reclaim VAT on purchases

- • Must charge VAT on all sales

- • Committed for minimum 12 months

- • Increased administrative burden

- • Can deregister if turnover stays low

EU VAT ID Number Format

Polish VAT identification numbers follow the standardized EU format: PL1234567890. This number is essential for all VAT-related transactions and must appear on invoices for business-to-business sales.

- • PL - Poland country code

- • 10 digits - Unique business identifier

- • Used for intra-EU transactions

- • Required on invoices for B2B sales

- • Enables 0% VAT on EU exports

- • Validates VAT exemption claims

- • Required for VAT return filings

- • Links to VIES database for verification

Frequently Asked Questions About VAT in Poland

Do I need to register for VAT when starting a business in Poland?▼

You must register for VAT if your annual turnover exceeds 200,000 PLN. Below this threshold, registration is voluntary but can be beneficial if you want to reclaim VAT on business expenses. New businesses should carefully consider their expected revenue and business model when deciding on VAT registration.

What's the standard VAT rate in Poland?▼

The standard VAT rate in Poland is 23%, which applies to most goods and services. However, there are reduced rates of 8% for certain items like books and pharmaceuticals, 5% for basic food products, and 0% for exports and some essential services. Always check which rate applies to your specific products or services.

Can I reclaim VAT on business expenses as a small business?▼

Only if you're VAT-registered. Small businesses with turnover below 200,000 PLN that choose to remain VAT-exempt cannot reclaim input VAT on purchases. However, you can voluntarily register for VAT to reclaim input VAT, though this means you must charge VAT on all sales and file regular returns.

How often do I need to file VAT returns in Poland?▼

Most businesses file monthly VAT returns by the 25th of the following month. Small businesses with annual turnover below 1.2 million PLN can apply for quarterly filing. All returns must be submitted electronically through the tax office's online system or approved accounting software.

What happens if I exceed the small business VAT threshold?▼

You must register for VAT within 14 days of exceeding 200,000 PLN in annual turnover and start charging VAT immediately. You'll need to issue corrective invoices for recent sales where VAT should have been charged. It's important to monitor your turnover throughout the year to avoid penalties.

Do I need to charge VAT on services provided to other EU countries?▼

For B2B services to VAT-registered businesses in other EU countries, you typically charge 0% VAT using the reverse charge mechanism. For B2C services, you may need to charge the customer's country VAT rate. Digital services to consumers always follow the destination principle. Always verify the customer's VAT status and applicable rules.

What documents do I need to register for VAT in Poland?▼

You'll need to complete the VAT-R form, provide your business registration documents, proof of address, and identification. EU citizens need their passport or ID card, while non-EU citizens may need additional residence permits. The process can usually be completed online or at your local tax office.

Can I cancel my VAT registration if my business shrinks?▼

Yes, if your turnover falls below 200,000 PLN and you were voluntarily registered, you can apply to cancel your VAT registration. However, you must remain registered for at least 12 months after voluntary registration. If you were mandatorily registered, you can only cancel if your turnover stays below the threshold for a full year.