Bank Accounts in Poland

Are you planning to move to Poland or already living here and looking for the perfect bank account to suit your needs? With plenty of options available, choosing the right bank account in Poland can be overwhelming. This guide will help you navigate the world of Polish banking, comparing digital banks, traditional banks, and international banks, while also providing you with essential information on fees, services, and documentation requirements. Let's dive in and find the best Polish bank account for you!

Table of Contents

mBank

Digital-first users and tech professionals

mBank

Digital-first users and tech professionals

Key Features

Account Details

Summary

PKO Bank Polski

First-time expats and students

PKO Bank Polski

First-time expats and students

Key Features

Account Details

Summary

BNP Paribas Bank Polska

International professionals and digital banking users

BNP Paribas Bank Polska

International professionals and digital banking users

Key Features

Account Details

Summary

Revolut

Digital nomads, frequent travelers, and tech-savvy users

Revolut

Digital nomads, frequent travelers, and tech-savvy users

Key Features

Account Details

Summary

VeloBank

Digital banking users and cashback seekers

VeloBank

Digital banking users and cashback seekers

Key Features

Account Details

Summary

Millennium Bank

High-net-worth individuals and business owners

Millennium Bank

High-net-worth individuals and business owners

Key Features

Account Details

Summary

Alior Bank

Polish speakers seeking loans and mortgages

Alior Bank

Polish speakers seeking loans and mortgages

Key Features

Account Details

Summary

Bank Pekao

Business banking and traditional banking preferences

Bank Pekao

Business banking and traditional banking preferences

Key Features

Account Details

Summary

Bank Handlowy (Citi Handlowy)

High-income professionals and international clients

Bank Handlowy (Citi Handlowy)

High-income professionals and international clients

Key Features

Account Details

Summary

Nest Bank

Cost-conscious users seeking basic banking

Nest Bank

Cost-conscious users seeking basic banking

Key Features

Account Details

Summary

Important Information

Most Polish banks offer their websites primarily in Polish. Use your browser's translation feature to navigate in English. If certain functions don't work in the translated version, switch back to Polish. Many banks provide English-speaking customer service through dedicated phone lines or at branches in major cities like Warsaw, Krakow, and Gdansk.

Why You Can Trust Us

We are independent from the providers of the financial products that we test and evaluate.

We are transparent regarding our research processes and evaluation methods.

Our content undergoes careful quality check to ensure that it is well-researched, factually correct, and understandable.

We have extensive experience with financial products and understand what expats in Poland want and need.

Choosing the Right Polish Bank Account

When selecting a Polish bank account, it's crucial to consider factors such as language support, accessibility, fees, and banking preferences. Recently, the Polish banking market has witnessed significant digital transformation, with many banks offering innovative features like user-friendly mobile apps, competitive fee structures, and English-language support. However, traditional banks remain popular among locals and expats alike due to their extensive branch networks and established reputation.

Having a Polish bank account is essential for various purposes, including employment, renting accommodation, and setting up utilities. A local bank account is required to receive your salary, pay rent, and manage day-to-day expenses. In the following sections, we'll delve deeper into the factors you should consider when choosing a Polish bank account.

Digital banking solutions for foreigners living in Poland.

Photo: Kaboompics.com / Pexels

Language Support and Accessibility

Language support and accessibility are crucial aspects to consider when selecting a Polish bank account, especially for expats and English speakers. While many banks in Poland have improved their English support significantly, the level of service varies considerably between institutions. Modern digital banks like mBank and VeloBank typically offer comprehensive English-language mobile apps and websites, making them popular choices among foreigners.

Opening an account with some traditional banks can be challenging for newcomers due to language barriers and complex procedures. However, international banks like BNP Paribas and Millennium have streamlined processes specifically designed for expats and English speakers. Many banks now use digital identity verification methods, making the account opening process more efficient and accessible to foreign residents.

Fees and Charges

Understanding the fee structure is vital when choosing a Polish bank account. Common fees include monthly account maintenance fees, credit card annual fees, ATM withdrawal charges, and international transfer costs. Many Polish banks offer fee-free basic accounts, particularly for students, young people, or customers who meet specific criteria such as minimum monthly deposits.

It's essential to compare fees across different banks to ensure you're getting the best value. For example, while PKO Bank Polski offers many fee-free services, some premium features may incur charges. Digital-first banks like mBank often provide competitive fee structures with transparent pricing, making them attractive for cost-conscious customers.

Banking Preferences and Infrastructure

Poland has embraced digital payments significantly, especially accelerated by recent global events. While cash is still widely used, particularly in smaller establishments and markets, card payments and mobile payments are increasingly common in urban areas. Most retailers, restaurants, and service providers in major cities like Warsaw, Krakow, and Gdansk readily accept card payments.

ATM availability is generally excellent in Poland, with most banks offering extensive networks. PKO Bank Polski has the largest ATM network in the country, while other banks often participate in shared ATM networks, reducing withdrawal fees for customers. Consider the ATM network size when choosing your bank, especially if you frequently need cash access.

If you prefer in-person banking services, traditional banks like PKO Bank Polski, Bank Pekao, and BNP Paribas have numerous branches across the country. These banks offer face-to-face customer service and can be particularly helpful for complex financial matters. However, if you're comfortable with digital banking, modern banks like mBank and VeloBank provide exceptional mobile banking experiences with 24/7 customer support and comprehensive online services.

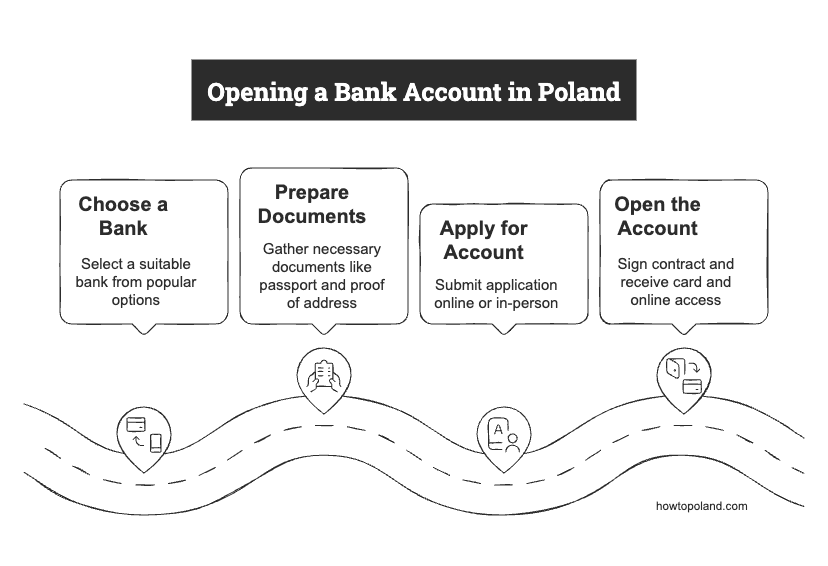

How to Open a Bank Account in Poland as a Foreigner (2025 Guide)

Opening a Polish bank account has become significantly easier in 2025. Most major banks now offer streamlined processes for foreigners, with digital applications and English support. EU citizens can typically complete the process in 15-30 minutes, while non-EU citizens may need 45-60 minutes due to additional documentation.

The biggest change in 2025 is that most banks no longer require upfront PESEL numbers - you can apply for both your bank account and PESEL simultaneously at major banks like PKO Bank Polski. This eliminates the previous chicken-and-egg problem that frustrated many expats.

Updated 2025 requirements: EU citizens need just passport + Polish address proof. Non-EU citizens need passport + residence permit/visa + income documentation. Digital banks like mBankoffer fully online applications with video verification.

Complete guide to banking procedures for expats in Poland.

Infographic: How to Poland Guide

Best Banks for foreigners in Poland

Digital banking in Poland has advanced significantly, with several banks offering full English support and streamlined online account opening. Here are the top three banks that consistently receive positive feedback from the expat community.

mBank

Winner of multiple digital banking awards, mBank offers completely digital account opening in English. Their mobile app consistently ranks #1 in Poland, and they provide 24/7 English customer support.

VeloBank

VeloBank offers 0 PLN monthly fees with no conditions and up to 50 PLN monthly cashback rewards. Their VeloKonto is popular among expats for its straightforward fee structure and excellent English customer service.

Alior Bank

Known for quick decision-making and innovative solutions, Alior Bank excels in mortgage and personal loan approvals. Their modern mobile app offers most features in English, though phone support is primarily in Polish.

Quick tip: Start with mBank if you want the easiest experience. Their English onboarding process is specifically designed for foreigners, and you can have an account ready in under 20 minutes.

Traditional Polish Banks for Newcomers

For those who prefer a more traditional banking experience, PKO Bank Polski, Bank Pekao, BNP Paribas, and Millennium Bank are excellent options for newcomers. These banks offer a range of services and features, along with the added benefit of physical branches across the country. However, they often come at a higher price range compared to their online counterparts.

Let's explore these traditional Polish banks in more detail.

Established banking institutions with extensive branch networks.

Photo: Kindel Media / pexels.com

PKO Bank Polski

PKO Bank Polski is Poland's largest bank, offering a comprehensive range of products and services for private customers, corporate clients, and institutions. They provide banking products, investment services, and financial advice with the largest ATM network in the country - over 20,000 locations.

While they offer fee-free basic accounts, some premium services come with charges. PKO provides various banking options including online banking, telephone banking, and 24/7 English-speaking customer service hotlines. Their extensive branch network and customer support make them a reliable choice for newcomers seeking traditional banking in Poland.

Bank Pekao and BNP Paribas

Bank Pekao and BNP Paribas are two of the largest traditional banks in Poland, offering comprehensive services including online banking, account transfers, and international banking solutions. BNP Paribas customers benefit from global network access and fee-free banking with conditions, while Bank Pekao provides extensive domestic ATM coverage with over 4,500 locations.

BNP Paribas offers 0 PLN monthly fees with conditions, while Bank Pekao typically charges monthly fees ranging from 0-20 PLN depending on the account type. BNP Paribas specializes in international banking and digital services, while Bank Pekao focuses on corporate banking and traditional retail services. It's essential to compare their fee structures to ensure you're getting the best value for your banking needs.

Millennium Bank

Millennium Bank is one of Poland's premium banks, offering specialized services such as current accounts, wealth management, private banking, and comprehensive loan products. They provide dedicated expat banking specialists and English-speaking private bankers, making them particularly suitable for high-net-worth individuals and international clients.

While Millennium Bank charges higher fees (0-25 PLN monthly) and requires minimum balance requirements for some accounts, they offer competitive rates and personalized service. Their extensive branch network and ATM coverage across Poland make them convenient for customers who prefer in-person banking services and premium financial advisory.

Specialized Banking Options in Poland

In addition to the online and traditional banks mentioned above, there are specialized banking options available in Poland that cater to specific needs. These options include business-friendly banks like mBank for entrepreneurs and student-focused accounts from various institutions.

Let's explore these specialized banking options in more detail.

Specialized banking options for different needs.

Photo: pexels.com

Business-Friendly Banks

Business-friendly banks offer services tailored to meet the unique requirements of entrepreneurs and self-employed individuals. mBank provides excellent business banking features including free business accounts, dedicated business mobile apps, quick loan approvals, and comprehensive accounting integrations.

While Polish law doesn't require separate business accounts for sole proprietors, choosing a business-focused bank like mBank can help simplify financial management with features like automatic transaction categorization, VAT calculations, and direct integration with Polish accounting software like iFirma or Fakturownia. If you're planning to start your own business in Poland, check our comprehensive guide to business registration which covers legal forms, required documents, and step-by-step registration process.

Student Banking Options

Banks for students in Poland provide specialized services such as student accounts with no monthly fees, overdraft facilities, student credit cards, and educational loans. Notable banks offering student packages include PKO Bank Polski, mBank, VeloBank, and BNP Paribas.

International students can often open accounts with just their student visa and university enrollment letter. Many banks offer special promotions for students including free credit cards, cashback on purchases, and no foreign transaction fees. It's essential to choose a bank that offers English support and understands the unique needs of international students studying in Poland.

Money Transfers and Payment Methods in Poland

Managing your finances in Poland goes beyond just having a bank account. Understanding money transfer options and payment preferences will help you navigate daily life more smoothly.

International Money Transfers

Sending money internationally from Poland can be expensive through traditional banks. Revolut offers excellent exchange rates and low fees for international transfers - often saving you 4-8x compared to traditional banks.

With Revolut, you can send money to over 150 countries at great exchange rates, spend abroad with no hidden fees, and manage multiple currencies in one app. Perfect for expats living in Poland who need to send money home or travel frequently.

Money-saving tip: Revolut uses interbank exchange rates with no hidden markups. A €1000 transfer typically costs just €2-5, while traditional Polish banks might charge €25-50 plus poor exchange rates.

Revolut card - perfect for international transfers and spending abroad.

Image: HowToPoland.com

Payment Methods in Poland

Poland has embraced contactless payments more than most European countries. Card payments are accepted almost everywhere, including small shops, taxis, and public transport. Apple Pay and Google Pay work with most Polish bank cards.

Card Payments

Widely accepted everywhere. Contactless limit is 100 PLN without PIN.

Cash (PLN)

Still useful for tips, small markets, and some traditional restaurants.

Mobile Pay

BLIK (Polish system) and international apps like Apple/Google Pay.

Essential Polish Banking Terms

Learning these key Polish banking terms will help you navigate bank websites, understand documents, and communicate more effectively:

Language tip: Most modern Polish banks offer English interfaces in their mobile apps. mBank's app is completely available in English, making it perfect for expats who prefer banking in their native language.

Frequently Asked Questions About Polish Banking

Can I open a Polish bank account without speaking Polish?▼

Yes, several banks offer full English support. mBank has completely English account opening, PKO Bank Polski provides 24/7 English customer service, and BNP Paribas has English-speaking staff in major cities. Many banks also offer English mobile apps.

Do I need a PESEL number to open a bank account?▼

Most banks require a PESEL number for full account functionality. However, you can often get a PESEL at the bank during your account opening appointment. Some banks like Millennium may open basic accounts without PESEL initially, but you'll need it for services like loans or investment products.

Which Polish bank is cheapest for foreigners?▼

PKO Bank Polski, mBank, and VeloBank offer accounts with 0 PLN monthly fees. mBank is particularly cost-effective for digital banking with free EU transfers, while VeloBank offers excellent cashback rewards. Avoid premium accounts unless you need specific services.

How long does it take to get a Polish bank card?▼

Physical cards typically arrive within 5-7 business days by mail. Many banks now offer instant digital cards through their mobile apps for immediate online payments. Some branches can issue temporary cards on the spot. PIN codes are usually sent separately within 2-3 days.

Can I open a bank account online in Poland?▼

Yes, mBank offers completely online account opening in English, usually taking 15-20 minutes. VeloBank and Alior Bank also support online applications. You'll need to upload documents and complete video verification. Traditional banks like PKO still require in-person visits.

What's the minimum amount needed to open an account?▼

Most basic accounts require no minimum deposit (0 PLN). Premium accounts may require 100-1000 PLN initial deposits. Millennium Bank typically requires 500 PLN for their premium services. Student accounts usually have no minimum requirements.

Are Polish banks safe for foreigners' money?▼

Yes, all major Polish banks are protected by the Bank Guarantee Fund (BFG), which insures deposits up to 100,000 EUR per person per bank. This is the same protection level as other EU countries. Banks like PKO, mBank, and BNP Paribas are also internationally regulated.

Can I use my Polish bank card abroad?▼

Yes, Polish bank cards work worldwide. Within the EU, most banks offer free or low-cost transactions. mBank and VeloBank offer competitive foreign exchange rates. Always notify your bank before traveling to avoid card blocks.

Ready to Open Your Polish Bank Account?

Choose from our top-ranked banks and start your banking journey in Poland. Compare features, read reviews, and find the perfect account for your needs.

Important Disclaimer

Information Accuracy: Bank fees, requirements, and services are subject to change. While we strive to keep information current (last updated January 2025), always verify details directly with your chosen bank before making decisions.

Affiliate Partnerships: This page contains affiliate links to some banking partners. We may receive compensation when you open accounts through these links, but this doesn't affect our rankings or recommendations, which are based on objective criteria and user feedback.

Individual Circumstances: Banking needs vary by individual situation. Consider your specific requirements (income level, residency status, planned duration in Poland) when choosing a bank. This guide provides general recommendations for typical expat scenarios.

Data Sources: Our rankings combine official bank fee schedules, customer service evaluations, user reviews from expat communities, and direct testing of banking services. We update information quarterly or when significant changes occur.