Credit Cards in Poland

Are you planning to move to Poland or already living here and looking for the perfect credit card to suit your needs? With plenty of options available, choosing the right credit card in Poland can be overwhelming. This guide will help you navigate the world of Polish credit cards, comparing features, fees, rewards, and approval requirements. Let's dive in and find the best Polish credit card for you!

Table of Contents

mBank Visa Credit Card

Digital banking users and cashback seekers

mBank Visa Credit Card

Digital banking users and cashback seekers

Key Features

Card Details

Summary

PKO Visa Credit Card

First-time credit card users and travelers

PKO Visa Credit Card

First-time credit card users and travelers

Key Features

Card Details

Summary

Santander Credit Card

Frequent travelers and premium users

Santander Credit Card

Frequent travelers and premium users

Key Features

Card Details

Summary

Revolut Credit Card

Digital-first expats and frequent travelers

Revolut Credit Card

Digital-first expats and frequent travelers

Key Features

Card Details

Summary

ING Visa Credit Card

International online shoppers

ING Visa Credit Card

International online shoppers

Key Features

Card Details

Summary

Millennium Mastercard

High-income professionals and luxury seekers

Millennium Mastercard

High-income professionals and luxury seekers

Key Features

Card Details

Summary

Important Information

Most Polish banks offer their websites primarily in Polish. Use your browser's translation feature to navigate in English. If certain functions don't work in the translated version, switch back to Polish. Many banks provide English-speaking customer service through dedicated phone lines or at branches in major cities like Warsaw, Krakow, and Gdansk.

Why You Can Trust Us

We are independent from the providers of the financial products that we test and evaluate.

We are transparent regarding our research processes and evaluation methods.

Our content undergoes careful quality check to ensure that it is well-researched, factually correct, and understandable.

We have extensive experience with financial products and understand what expats in Poland want and need.

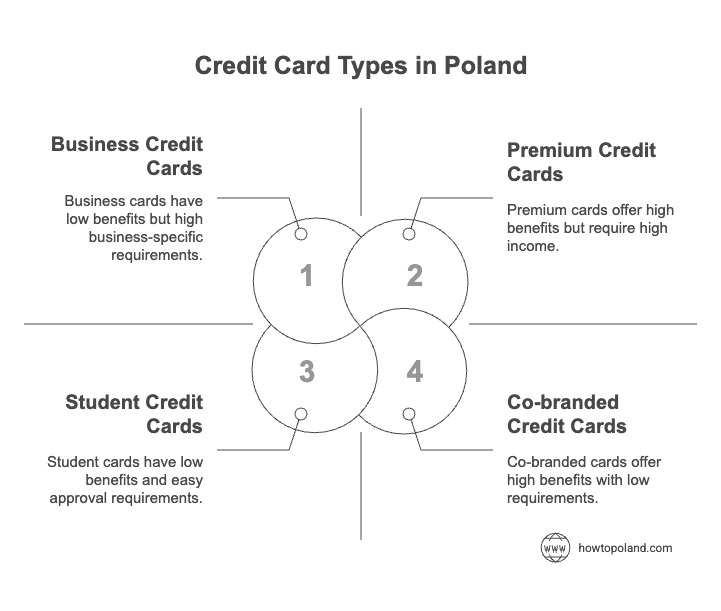

Types of Credit Cards in Poland

Polish credit cards fall into several distinct categories, each designed for different spending habits and financial situations. Unlike some countries where credit cards are the primary payment method, Poland still relies heavily on debit cards for daily transactions. However, credit cards are becoming increasingly popular among younger professionals and expats who appreciate the flexibility and rewards programs.

The credit card market in Poland is dominated by Visa and Mastercard, with American Express having limited acceptance outside major cities. Most Polish credit cards offer contactless payments (called "zbliżeniowe" in Polish), which is essential since many merchants have minimum amounts for traditional chip-and-PIN transactions.

Standard Credit Cards (Karty Kredytowe Standardowe)

Standard credit cards are the most common type in Poland, typically offering credit limits between 5,000-20,000 PLN ($1,200-$4,800 / €1,100-€4,400) depending on your income. These cards usually have no annual fee or a low fee (0-50 PLN / $0-$12 / €0-€11), making them accessible to most working professionals. The interest rates range from 15-25% APR, which is relatively high compared to Western European standards but typical for the Polish market.

Banks like PKO, mBank, and ING offer competitive standard cards with basic rewards programs. Most include fraud protection, online shopping insurance, and 24/7 customer support. The application process typically takes 3-7 business days, and you'll need to show proof of income (usually a minimum of 2,000-2,500 PLN / $480-$600 / €440-€550 monthly salary).

Premium and Gold Cards (Karty Premium/Złote)

Premium credit cards in Poland target higher-income customers with monthly salaries above 4,000-5,000 PLN ($960-$1,200 / €880-€1,100). These cards offer enhanced benefits like travel insurance, airport lounge access, concierge services, and higher cashback rates (typically 1-3% on purchases). Annual fees range from 100-300 PLN ($24-$72 / €22-€66), but many banks waive the fee if you spend a certain amount annually.

Santander's World Elite and Millennium's Platinum cards are popular choices among expats working in corporate roles. These cards often include additional perks like extended warranty protection, car rental insurance, and priority customer service in English. Credit limits can reach 50,000-100,000 PLN ($12,000-$24,000 / €11,000-€22,000) for qualified applicants.

Digital-First and Fintech Cards

The newest category includes cards from digital banks and fintech companies like Revolut, which has gained significant popularity among Polish millennials and expats. These cards typically offer instant approval, no foreign transaction fees, real-time spending notifications, and competitive exchange rates for international purchases.

Digital cards often come with innovative features like spending categorization, budget tracking, and the ability to freeze/unfreeze your card instantly through a mobile app. Many offer metal card options for premium users and have lower income requirements compared to traditional banks.

For expats, these cards are particularly attractive because they offer full English support, transparent fee structures, and don't require extensive Polish banking history. However, acceptance can be limited at smaller merchants who prefer traditional Polish bank cards.

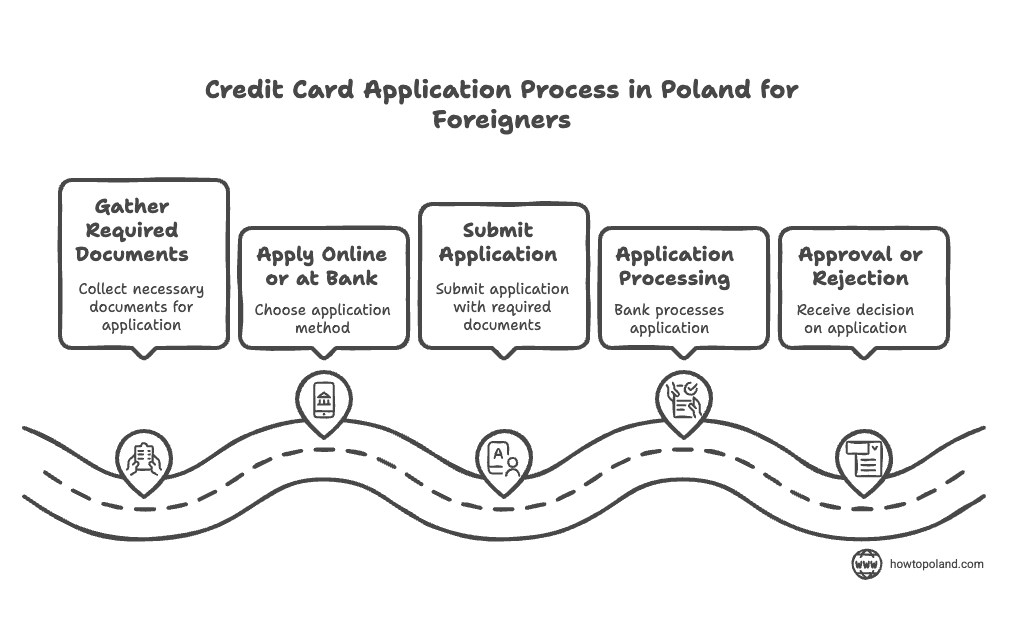

How to Apply for a Credit Card in Poland as a Foreigner

Getting a credit card in Poland as a foreigner is straightforward if you have a Polish bank account and regular income. Most banks require 3-6 months of banking history, but digital banks like Revolut can approve applications instantly for existing customers. You'll need your passport, proof of Polish address, and recent pay slips showing at least 2,000 PLN monthly income.

EU citizens typically get faster approval since banks view them as lower risk. Non-EU citizens might face stricter requirements, including a longer employment history (6-12 months) and higher income thresholds. Banks like mBank and PKO have English-speaking staff who understand expat situations and can guide you through the process.

Pro tip: Start with a standard card from your existing bank - they already know your financial situation. Once you build credit history in Poland (usually 12 months), you can apply for premium cards with better rewards and higher limits.

Credit Card in Poland as a Foreigner

Photo: Kaboompics.com / Pexels

Best Credit Cards for Expats and English Speakers

Digital banking in Poland has advanced significantly, with several banks offering credit cards with full English support and streamlined online applications. Here are the top three credit card providers that consistently receive positive feedback from the expat community.

mBank Credit Card

Winner of multiple digital banking awards, mBank offers completely digital credit card applications in English. Their credit cards come with cashback programs and instant approval for existing customers with 24/7 English customer support.

Revolut Credit Card

While Revolut isn't a traditional Polish bank, it works brilliantly for expats. As a Pole living in Poland, I often use it myself for its excellent exchange rates and instant notifications. Perfect for digital-first users who want full English support and global acceptance.

Alior Bank Credit Card

Known for quick decision-making and innovative solutions, Alior Bank offers competitive credit cards with fast approval processes. Their modern mobile app offers most features in English, making it accessible for expats, though phone support is primarily in Polish.

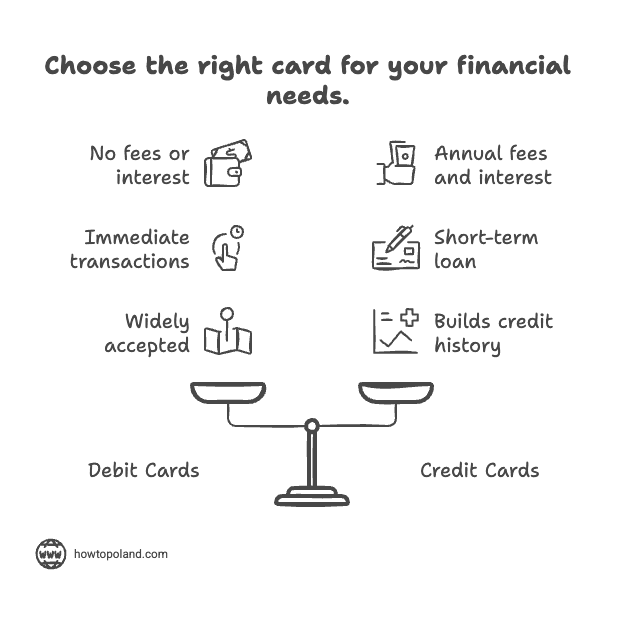

Debit Cards vs Credit Cards in Poland: What's the Difference?

When you open a Polish bank account, you'll automatically get a debit card (karta debetowa) for free. But should you also apply for a credit card? The choice isn't obvious because Polish banking culture differs significantly from countries like the US or UK, where credit cards dominate daily spending.

Here's the reality: 80% of Polish transactions happen with debit cards, not credit cards. Most locals prefer spending their own money rather than borrowing, which means credit cards are mainly used for emergencies, online shopping, or building credit history.

As an expat, understanding when to use each type will save you money and help you integrate better into Polish financial culture.

Polish Debit Cards (Karty Debetowe)

Debit cards in Poland work exactly like they do worldwide - they're directly connected to your bank account and deduct money immediately when you make a purchase. Every Polish bank account comes with a free debit card, usually Visa or Mastercard, which you can use at any shop, restaurant, or ATM across Poland and Europe.

Polish debit cards are perfect for daily expenses like groceries, public transport, and dining out. Most merchants prefer debit cards over cash, especially for contactless payments under 100 PLN ($24 / €22). You'll get your debit card within 5-7 days of opening your account, and it's completely free with most Polish banks like PKO, mBank, or ING.

Polish Credit Cards (Karty Kredytowe)

Credit cards in Poland work like a short-term loan - you borrow money from the bank to make purchases, then pay it back later with interest if you don't pay the full amount by the due date. Unlike debit cards, credit cards require a separate application process and income verification, typically requiring at least 2,000-2,500 PLN monthly salary.

Polish credit cards are ideal for building credit history, earning rewards, and handling larger purchases or emergencies. They also offer better fraud protection and are preferred for online shopping and international travel. However, they come with annual fees (0-300 PLN) and high interest rates (15-25% APR) if you carry a balance.

Which Card Should You Choose First?

As a newcomer to Poland, start with a debit card from your chosen bank - it's free, immediate, and covers all your daily needs. Most expats find that a debit card handles 90% of their transactions in Poland, from grocery shopping at Biedronka to paying for trams in Warsaw or Krakow.

After 3-6 months of banking history, consider applying for a credit card if you want to build Polish credit, earn cashback, or need the extra security for online purchases. Digital banks like Revolut offer instant credit approval, while traditional banks like PKO or Santander provide more comprehensive credit building opportunities.

Expert Tip:

Many Polish merchants still prefer debit cards over credit cards due to lower processing fees. If you're planning to shop at smaller local businesses or markets, a debit card will always be accepted, while some places might not take credit cards.

Debit Card Benefits

- ✓No annual fees or interest charges

- ✓Immediate transaction processing

- ✓Accepted everywhere in Poland

- ✓Helps control spending (can't overspend)

- ✓Free ATM withdrawals at your bank's network

Credit Card Benefits

- ✓Builds credit history in Poland

- ✓Cashback and rewards programs

- ✓Better fraud protection

- ✓Emergency financial flexibility

- ✓Travel insurance and perks (premium cards)

The BIK Check and its Impact on Credit Card Applications

In Poland, while anyone can apply for a credit card, there are basic requirements that must be met, such as being a Polish resident and being of legal age (18+). Beyond these criteria, credit card providers have additional conditions that applicants must satisfy. The type of credit card you can obtain largely depends on your credit history in Poland.

When applying for a Polish credit card with a credit limit, banks consider this a potential risk and conduct thorough credit checks to evaluate your financial reliability.

Credit check process affects approval chances

Photo: Kindel Media / Pexels

Polish Credit Bureau (BIK) System

When applying for a Polish credit card with a credit limit, banks conduct a credit check through BIK (Biuro Informacji Kredytowej) - Poland's largest credit reporting agency. BIK maintains records of all credit applications, loans, and payment histories for Polish residents, similar to how Schufa operates in Germany.

If you have a negative BIK record due to delayed payments, unpaid bills, or previous loan defaults, your chances of approval for a traditional credit card are significantly reduced. Banks need assurance that customers can repay borrowed money in a timely manner, making your credit history crucial for approval.

However, debit cards and prepaid credit cards are usually issued without a BIK check. Since these cards don't offer actual credit, they don't pose significant risk to banks while still providing essential payment features including contactless transactions and ATM withdrawals.

Fees Associated with Polish Credit Cards

With traditional credit cards in Poland, holders must expect interest charges when using flexible repayment options. If you don't pay the full credit card bill within the interest-free period (usually 25-55 days) and choose installment payments instead, interest rates typically range from 15-25% APR.

Interest rates vary significantly between providers. Additional fees may apply for foreign currency transactions, ATM withdrawals, or annual membership fees. Some premium cards waive annual fees if you spend above certain thresholds annually.

Annual Fees

Range: 0-300 PLN ($0-$72 / €0-€66)

Premium cards with travel insurance, cashback programs, and concierge services typically charge higher fees.

Foreign Currency Fees

Range: 1.5-4% per transaction

Charged when paying in currencies other than PLN. Digital banks often offer better rates.

Cash Withdrawal Fees

Range: 5-15 PLN ($1.20-$3.60 / €1.10-€3.30) + 2-4%

Some banks offer free withdrawals at their own ATM network or partner locations.

Interest Rates and Repayment Options

Polish credit cards typically provide monthly credit limits ranging from 5,000-50,000 PLN ($1,200-$12,000 / €1,100-€11,000) depending on your income and credit history. Traditional credit cards offer the option to repay borrowed amounts in monthly installments, but this comes with interest charges on the outstanding balance.

Interest rates in Poland are variable and charged only on the borrowed amount, not the entire credit limit. When comparing credit card offers, focus on the effective annual interest rate (RRSO in Polish) rather than just the nominal rate, as this gives a complete picture of total interest costs.

Pro Tip for Expats:

If you're new to Poland and lack local credit history, consider starting with a secured credit card or building your BIK score through consistent debit card usage and bill payments before applying for premium credit cards with better terms.

How to Get a Credit Card in Poland as a Foreigner

Getting a credit card in Poland as a foreigner requires more documentation than opening a basic bank account. The application process typically takes 3-14 days, depending on whether you apply online with digital banks like Revolut or through traditional banks like PKO Bank Polski.

We'll cover the specific requirements, income verification process, and compare different application methods to help you choose the best approach for your situation.

Required Documents for Credit Card Application

Credit card applications require more documentation than debit cards since banks need to verify your ability to repay credit. Here's what you'll need to prepare:

EU Citizens Need:

- • Valid European ID card or passport

- • Proof of Polish address (rental contract, utility bill)

- • PESEL number (required for credit applications)

- • Employment contract or business registration

- • Last 3 months' pay slips (minimum 2,000 PLN ($480 / €440)/month)

- • Bank statements from Polish account (3-6 months)

Non-EU Citizens Need:

- • Valid passport (6+ months remaining)

- • Residence permit or long-term visa

- • PESEL number (mandatory for credit products)

- • Employment contract (minimum 6 months history)

- • Last 3 months' pay slips (minimum 2,500 PLN ($600 / €550)/month)

- • Polish bank account statements (6+ months preferred)

- • Proof of address registration in Poland

Important: Digital banks like Revolut may have more flexible requirements, while traditional Polish banks typically require 3-6 months of local banking history before approving credit cards.

Income Requirements and Verification

Polish banks have strict income requirements for credit cards. Your monthly salary determines both approval chances and credit limit. Here's what different banks typically require:

Standard Cards

2,000 PLN

($480 / €440)

Minimum monthly income

Credit limit: 3-5x monthly salary

Premium Cards

4,000 PLN

($960 / €880)

Minimum monthly income

Credit limit: 5-8x monthly salary

Digital Banks

1,500 PLN

($360 / €330)

Minimum monthly income

More flexible verification

Self-Employed Applicants:

If you're self-employed or run a business in Poland, you'll need to provide additional documentation including business registration (KRS/CEIDG), tax returns (PIT), and 6-12 months of business bank statements. Some banks may require 12+ months of business operation history.

Application Process: Online vs. In-Person

Online Opening

- • Open from anywhere, 24/7

- • Usually faster (15-30 minutes)

- • mBank offers full English process

- • No waiting in queues

- • May need video verification

- • Limited to digital-first banks

- • Some documents need uploading

In-Person Opening

- • Personal guidance and support

- • Can ask questions directly

- • Available at all major banks

- • Immediate card collection possible

- • Need to book appointment

- • Limited English in smaller cities

- • Takes 45-90 minutes

BLIK: Poland's Mobile Payment System You Need to Know

If you're getting a credit card in Poland, you'll quickly discover BLIK - a uniquely Polish payment system that's everywhere. Understanding BLIK is crucial for expats because it's how most Poles pay for everything from coffee to online shopping, and it works with both your credit and debit cards.

What is BLIK and Why Every Expat Should Use It

BLIK is Poland's homegrown mobile payment system that generates 6-digit codes in your banking app for instant payments. Think of it as Poland's answer to Apple Pay, but it works with any smartphone and any Polish bank account - including your new credit card.

Here's what makes BLIK special: over 80% of Polish adults use it regularly. When you're at Żabka (corner shop), ordering food delivery, or shopping online, cashiers will often ask "BLIK?" before mentioning card payments. It's that integrated into Polish culture.

BLIK - Poland's most popular mobile payment system

Learn more about BLIK →How BLIK Works with Your Polish Credit Card

Once you get your Polish credit card, BLIK becomes incredibly useful. You can link both your debit and credit cards to BLIK, then choose which one to use for each payment. This is perfect for managing your spending - use debit for daily expenses and credit for larger purchases or when you want to earn rewards.

Here's what makes BLIK special for credit card users: there are no additional fees from BLIK itself (your bank's credit card terms still apply), it works for online shopping on Polish websites, and you can even withdraw cash from ATMs using just your phone and a BLIK code.

Step-by-Step: Using BLIK

- 1. Open your Polish banking app

- 2. Find "BLIK" section (usually on main screen)

- 3. Choose debit or credit card

- 4. Generate 6-digit code (valid for 2 minutes)

- 5. Enter code at payment terminal or online

- 6. Confirm payment in your app

Where You'll Use BLIK Most

- • Żabka, Biedronka (grocery stores)

- • Allegro.pl (Polish Amazon equivalent)

- • Food delivery (Uber Eats, Glovo, Pyszne.pl)

- • Public transport ticket machines

- • Online government services (e-Urząd)

- • Parking meters in major cities

Expat Pro Tip: BLIK is so common that some Polish websites only accept BLIK or traditional bank transfers, not international cards like Visa/Mastercard. Having BLIK means you can shop anywhere online in Poland without limitations.

Essential Polish Credit Card Terms

Understanding these Polish credit card terms will help you navigate applications, read contracts, and communicate with bank staff more effectively:

Currency Exchange Disclaimer

Important: All USD and EUR conversions shown throughout this page are estimated based on approximate exchange rates and are provided for reference only. Currency exchange rates fluctuate daily and actual costs may vary when paying with foreign cards or converting currency. Always check current exchange rates before making financial decisions.

Frequently Asked Questions About Credit Cards in Poland

Can I get a credit card in Poland as a foreigner?▼

Yes, foreigners can apply for credit cards in Poland. You'll need a PESEL number, proof of income (minimum 2,000-2,500 PLN ($480-$600 / €440-€550) monthly), and 3-6 months of Polish banking history. EU citizens typically have easier approval processes. Digital banks like Revolut offer more flexible requirements.

What credit limit can I expect on my first Polish credit card?▼

First-time credit card holders in Poland typically receive limits of 3-5 times their monthly salary. With a 3,000 PLN ($720 / €660) salary, expect 9,000-15,000 PLN ($2,160-$3,600 / €1,980-€3,300) credit limit. Your limit depends on income, credit history, and employment stability. After 12 months of good payment history, you can request increases.

Are there credit cards in Poland with no annual fee?▼

How long does credit card approval take in Poland?▼

Credit card approval in Poland takes 3-14 business days. Digital banks like Revolut can approve applications instantly if you're an existing customer. Traditional banks (PKO, Santander) typically take 5-7 days for decision and another 5-7 days for card delivery. Instant digital cards are available for immediate online use.

What happens if I miss a credit card payment in Poland?▼

Missing payments in Poland results in late fees (typically 20-50 PLN ($4.80-$12 / €4.40-€11)), higher interest rates, and negative BIK credit bureau records. After 30 days, it's reported to BIK, affecting future credit applications. Contact your bank immediately if you can't make payments - many offer payment deferrals or restructuring options.

Can I use Polish credit cards for online shopping abroad?▼

Yes, Polish credit cards work for international online shopping. However, foreign currency fees apply (typically 1.5-4% per transaction). Revolut offers 0% foreign transaction fees, making it ideal for international purchases. Always inform your bank about foreign transactions to prevent security blocks.

Do Polish credit cards offer cashback or rewards?▼

Yes, many Polish credit cards offer cashback (0.5-2%) or points programs. mBank provides up to 1% cashback on purchases, while premium cards from Santander and PKO offer travel rewards and shopping discounts. Revolut offers metal cards with higher cashback rates for premium subscribers.

What documents do I need to apply for a Polish credit card?▼

You'll need: valid passport/ID, PESEL number, proof of Polish address, employment contract, last 3 months' pay slips, and Polish bank statements (3-6 months). Non-EU citizens may need residence permits. Self-employed applicants need business registration and tax returns (PIT).

Ready to Apply for Your Polish Credit Card?

Choose from our top-ranked credit cards and start building your credit in Poland. Compare features, rewards, and find the perfect card for your needs.