Investment Brokers in Poland

Looking to invest in stocks, ETFs, or other securities while living in Poland? Choosing the right investment broker is crucial for building wealth and achieving your financial goals. This comprehensive guide compares the best investment brokers available to Polish residents, covering everything from fees and platforms to market access and regulatory protection. Whether you're a beginner or experienced trader, find the perfect broker for your investment journey.

Table of Contents

XTB

European stock and ETF investors

Key Highlights

Advantages

- 0% commission on ETFs and stocks

- Award-winning xStation platform

- Full English support

- EU regulation and investor protection

- Wide range of international markets

Considerations

- Limited cryptocurrency options

- No fractional shares

Interactive Brokers

Advanced traders and global diversification

Interactive Brokers

Advanced traders and global diversification

Key Highlights

Advantages

- Access to 150+ global markets

- Lowest margin rates in industry

- Advanced trading tools and analytics

- All asset classes available

- Excellent mobile and desktop platforms

Considerations

- Complex platform for beginners

- Monthly inactivity fees for small accounts

Revolut

Beginner investors and mobile trading

Key Highlights

Advantages

- Commission-free stock trading

- User-friendly mobile app

- Multi-currency account integration

- Fractional shares available

- No minimum deposit

Considerations

- Limited to mobile app

- Fewer advanced trading tools

- Limited market access

mBank

Polish market investors and mBank customers

mBank

Polish market investors and mBank customers

Key Highlights

Advantages

- Integrated with mBank account

- Strong Polish market coverage

- Professional research and analysis

- Local customer support

- Traditional brokerage services

Considerations

- Higher fees than international brokers

- Limited international market access

- Older platform technology

Why You Can Trust Our Broker Reviews

We are independent from the brokers that we review and compare.

We are transparent about our research methods and evaluation criteria.

Our content is carefully fact-checked to ensure accurate and up-to-date information.

We have extensive experience with investment platforms and understand what investors need.

Choosing the Right Investment Broker in Poland

When selecting an investment broker in Poland, it's crucial to consider factors such as trading fees, available markets, platform quality, and regulatory protection. The Polish investment landscape offers both local and international brokers, each with unique advantages for different types of investors.

Having a reliable broker is essential for building wealth through investing. Whether you're interested in Polish stocks, international ETFs, or global diversification, the right broker can make a significant difference in your investment returns and overall experience.

Choose the right broker for your investment goals.

Photo: Joslyn Pickens - pexels.com

Types of Investment Brokers

International Brokers

Global platforms like Interactive Brokers offering access to worldwide markets with competitive fees.

European Brokers

EU-regulated brokers like XTB providing strong investor protection and European market focus.

Local Polish Brokers

Traditional brokers like mBank offering local market expertise and integrated banking services.

Key Factors to Consider

Costs and Fees

- • Trading commissions and spreads

- • Account maintenance fees

- • Currency conversion costs

- • Withdrawal and deposit fees

Investment Options

- • Available markets and exchanges

- • Stock and ETF selection

- • Fractional shares availability

- • Alternative investments

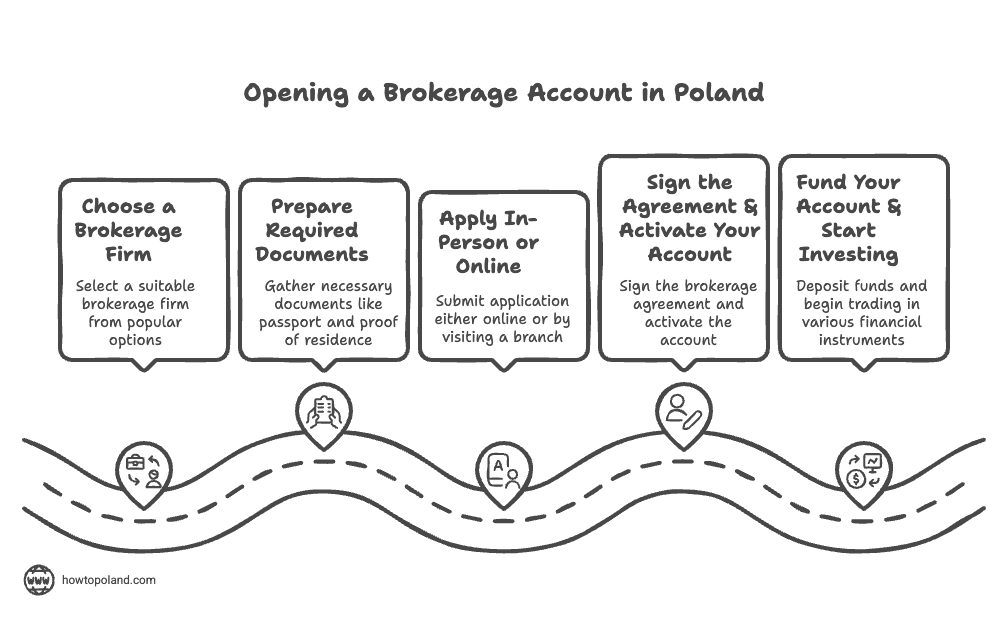

How to Open a Brokerage Account in Poland as a Foreigner

If you've never invested before and are living in Poland as a foreigner, opening your first brokerage account might seem intimidating. The good news is that it's actually much simpler than opening a bank account, and you don't need to understand complex financial terms to get started. This step-by-step guide will walk you through exactly what you need to do, what documents to prepare, and what to expect during the process.

First, let's clarify what a brokerage account actually is. Think of it as a special bank account designed specifically for buying and selling investments like stocks or funds. Unlike your regular bank account where you keep money for daily expenses, a brokerage account lets you use that money to purchase pieces of companies (stocks) or investment funds that can grow in value over time.

Step 1: Gather Your Documents

Before you start the application process, collect these documents. Having everything ready will make the process much faster and smoother.

If you're an EU citizen, you need:

- Your passport or European ID card (must be valid for at least 6 months)

- Proof of address in Poland - this can be a rental contract, utility bill, or even a letter from your employer confirming your address

- Your phone number and email address

- PESEL number (if you have one - don't worry if you don't, most brokers let you add it later)

If you're a non-EU citizen, you also need:

- Your residence permit (karta pobytu) or long-term visa

- Proof of income - this could be an employment contract, recent pay slips, or bank statements

- Sometimes a translated version of your documents (check with your chosen broker)

Step 2: Choose Your Broker

This is the most important decision for beginners. There are two main types of brokers available to foreigners in Poland, and your choice will significantly impact your experience.

Option A: Polish Brokers (Recommended for Beginners)

XTB is the most popular choice for foreign beginners. They're actually a Polish company, so they understand local regulations perfectly. They automatically calculate your taxes, provide statements in the format Polish tax authorities want, and their customer service speaks excellent English. The platform is designed to be user-friendly for people who have never invested before.

Option B: International Brokers (For More Advanced Users)

Interactive Brokers offers access to more markets and investment options, but requires you to handle Polish tax calculations yourself. Revolut is the simplest option with a mobile-only approach, perfect if you want to start with small amounts and learn gradually.

Step 3: Complete the Online Application

Once you've chosen your broker, go to their website and look for "Open Account" or "Register" button. The application process typically takes 15-30 minutes and involves several steps:

- Personal Information: Enter your name, address, phone number, and email exactly as they appear on your documents

- Employment Details: Provide information about your job, income, and employer

- Investment Experience: Answer honestly about your investment knowledge - it's okay to say you're a beginner

- Document Upload: Take clear photos of your documents and upload them through the website

- Identity Verification: This might involve a video call or uploading a selfie with your ID

Step 4: Wait for Approval and Fund Your Account

Most brokers will review your application within 24-48 hours. You'll receive an email when your account is approved. Once approved, you'll need to transfer money into your brokerage account before you can start investing. You can usually do this through a regular bank transfer from your Polish bank account.

Important for beginners: Start small. You don't need thousands of zloty to begin investing. Many brokers allow you to start with as little as 100-500 PLN. This lets you learn how everything works without risking significant money while you're still learning.

Common Concerns for First-Time Investors

What about the PESEL number?

Many foreigners worry about not having a PESEL number. The truth is, most brokers let you open an account without one and add it later. You can get a PESEL at any city hall (urząd miasta) - it's free, takes about 15 minutes, and you just need your passport and proof of address registration.

What about taxes?

As a Polish resident, you'll pay 19% tax on any investment profits. If you choose a Polish broker like XTB, they handle this automatically. If you choose an international broker, you'll need to calculate and pay these taxes yourself when filing your annual tax return.

Is my money safe?

All recommended brokers are regulated by financial authorities and participate in investor protection schemes. Your money is kept separate from the broker's own funds, so even if the broker faces financial problems, your investments remain protected.

Final advice for beginners: Don't rush into investing immediately after opening your account. Spend a few weeks familiarizing yourself with the platform, reading educational materials, and understanding how different investments work. Most brokers offer demo accounts or educational resources specifically designed for beginners. Remember, successful investing is about patience and learning, not quick profits.

International vs Local Brokers: Which is Better?

The choice between international and local brokers depends on your investment goals, experience level, and preference for customer service. Here's a detailed comparison to help you decide.

International Brokers

International brokers like Interactive Brokers and XTB offer access to global markets with competitive fees and advanced trading tools. They're regulated by multiple authorities and provide excellent English support.

Local Polish Brokers

Local brokers like mBank offer integrated banking services and deep knowledge of the Polish market. They provide local customer support and simplified tax reporting for Polish residents.

Trading Fees and Costs Comparison

Understanding the fee structure is crucial when choosing a broker. Here's a comprehensive breakdown of costs you'll encounter with different brokers in Poland.

Types of Fees to Consider

Trading Fees

- • Stock trading commissions

- • ETF trading fees

- • Currency conversion costs

- • Market data fees

Account Fees

- • Monthly maintenance fees

- • Inactivity fees

- • Withdrawal fees

- • Transfer fees

Cost Comparison by Broker Type

| Broker | Stock Trading | ETF Trading | Monthly Fee |

|---|---|---|---|

| XTB | 0% (up to €100k/month) | 0% | €0 |

| Interactive Brokers | From $0.35 | From $0.35 | $0-10 |

| Revolut | 0% | 0% | €0 |

| mBank | 0.39% (min 19 PLN) | 0.39% (min 19 PLN) | 0 PLN |

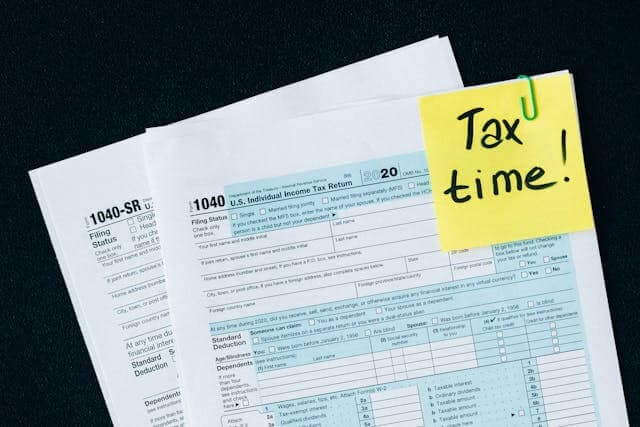

Tax Implications for Polish Residents

As a Polish tax resident, you'll need to pay 19% capital gains tax on investment profits. The tax treatment varies depending on your broker and the type of investments you hold. Understanding these implications is crucial for maximizing your after-tax returns.

Some brokers offer simplified tax reporting for Polish residents, while others require you to calculate and report gains yourself. International investments may also be subject to withholding taxes in the country of origin.

Understanding tax obligations for Polish resident investors.

Photo: Nataliya Vaitkevich - pexels.com

Polish Investment Tax Rules

Capital Gains Tax

19% flat rate on all investment gains for Polish tax residents. This applies to stocks, ETFs, bonds, and other securities.

Annual allowance: First 1,360 PLN of gains are tax-free for individual investors.

Withholding Taxes

US stocks: 15% withholding tax (reduced from 30% due to tax treaty)

EU stocks: Usually 0% withholding tax for Polish residents

Tax Reporting by Broker

XTB (Polish Broker)

Automatically calculates and withholds Polish capital gains tax. Provides annual tax statements in Polish for easy filing.

International Brokers (IBKR, Revolut)

Provide transaction reports, but you must calculate and pay Polish taxes yourself. Consider hiring a tax advisor for complex portfolios.

Available Investment Options in Poland

Polish residents have access to a wide range of investment options through various brokers. From local Polish stocks to international ETFs and bonds, here's what you can invest in.

Asset Classes Available

Stocks

Polish stocks (WSE), European stocks, US stocks, and emerging markets through various brokers.

ETFs

European ETFs (UCITS), US ETFs (limited access), and thematic ETFs covering various sectors and regions.

Bonds

Polish government bonds, corporate bonds, and international bonds through select brokers.

Popular Investment Strategies for Polish Residents

Long-term Investing

- • Global diversified ETFs (VWCE, IWDA)

- • Regular monthly investing (DCA strategy)

- • Focus on low-cost index funds

- • Tax-efficient European ETFs

Active Trading

- • Polish blue-chip stocks (PKO, CD Projekt)

- • European stocks with strong fundamentals

- • Sector-specific ETFs for tactical allocation

- • Currency hedged investments

Which Trading Platform Should You Choose?

The biggest mistake expats make is choosing a broker based on flashy marketing instead of what actually matters: English support, ease of use, and reliable customer service when you need help.

Here's my honest assessment of the three platforms that actually work for expats in Poland, based on real user experiences and practical testing.

Choose the right platform for your investment journey.

Photo: TheInvestorPost - pexels.com

The Simple Decision Framework

Complete Beginner? Start with Revolut

Never invested before or want to learn with small amounts

Perfect for your first €50-500. The app is foolproof, you can't really mess anything up, and it's free to try. Once you understand the basics, you can move to a more advanced platform.

Serious About Investing? Choose XTB

Ready to invest €1,000+ and want professional tools

This is what most expats end up using long-term. Great English support, handles Polish taxes automatically, and the platform is professional but not overwhelming. Zero fees on ETFs.

Experienced Trader? Consider Interactive Brokers

Already comfortable with investing and want global markets

Only choose this if you're already experienced with investing. The platform is powerful but complex, and you'll need to handle Polish tax calculations yourself.

Quick Comparison

| Platform | Best For | Minimum | Complexity |

|---|---|---|---|

| Revolut | Complete beginners | €1 | ⭐ Very Easy |

| XTB | Most expats | €0 | ⭐⭐ Moderate |

| Interactive Brokers | Experienced traders | $0 | ⭐⭐⭐ Complex |

Regulation and Investor Protection

Investor protection is crucial when choosing a broker. All recommended brokers are regulated by reputable financial authorities and participate in investor compensation schemes to protect your investments.

Regulatory Authorities

Polish Financial Supervision Authority (KNF)

Regulates XTB and other Polish brokers. Provides strong investor protection under EU regulations.

International Regulators

IBKR: SEC (US), FCA (UK), ASIC (Australia). Revolut: Bank of Lithuania, FCA (UK).

Investor Compensation Schemes

Protection levels: EU brokers provide up to €20,000 compensation per investor. US brokers like IBKR offer up to $500,000 SIPC protection. Your investments are held in segregated accounts, separate from the broker's own funds.

Frequently Asked Questions About Investment Brokers in Poland

Which broker is best for beginners in Poland?▼

For beginners, Revolut offers the most user-friendly experience with commission-free trading and a simple mobile app. XTB is also excellent for beginners with its educational resources and 0% ETF fees, making it ideal for long-term investing.

Are my investments safe with these brokers?▼

Yes, all recommended brokers are regulated by reputable financial authorities. XTB is regulated by the Polish Financial Supervision Authority (KNF), Interactive Brokers by multiple regulators including SEC and FCA, and Revolut by the Bank of Lithuania. Your investments are protected by investor compensation schemes.

What are the tax implications of investing through these brokers?▼

As a Polish tax resident, you'll pay 19% capital gains tax on investment profits. Some brokers like XTB can help with Polish tax reporting, while others require you to report gains yourself. Consult with a tax advisor for complex situations involving international investments.

Can I invest in US stocks from Poland?▼

Yes, all major brokers offer access to US markets. Interactive Brokers provides the widest selection, while XTB and Revolut offer popular US stocks and ETFs. Be aware of currency conversion costs and potential withholding taxes on US investments.

Which broker has the lowest fees?▼

For ETFs, XTB offers 0% commission. For stocks, Revolut offers commission-free trading. Interactive Brokers has the lowest overall costs for active traders with their tiered pricing structure. Compare based on your specific trading patterns.

Ready to Start Investing in Poland?

Choose from our top-rated brokers and start building your investment portfolio today. Compare features, fees, and find the perfect platform for your investment goals.